The client, a Private Equity firm, wanted the TresVista team to prepare an ESG Scorecard for a GP on whom the client was conducting due diligence.

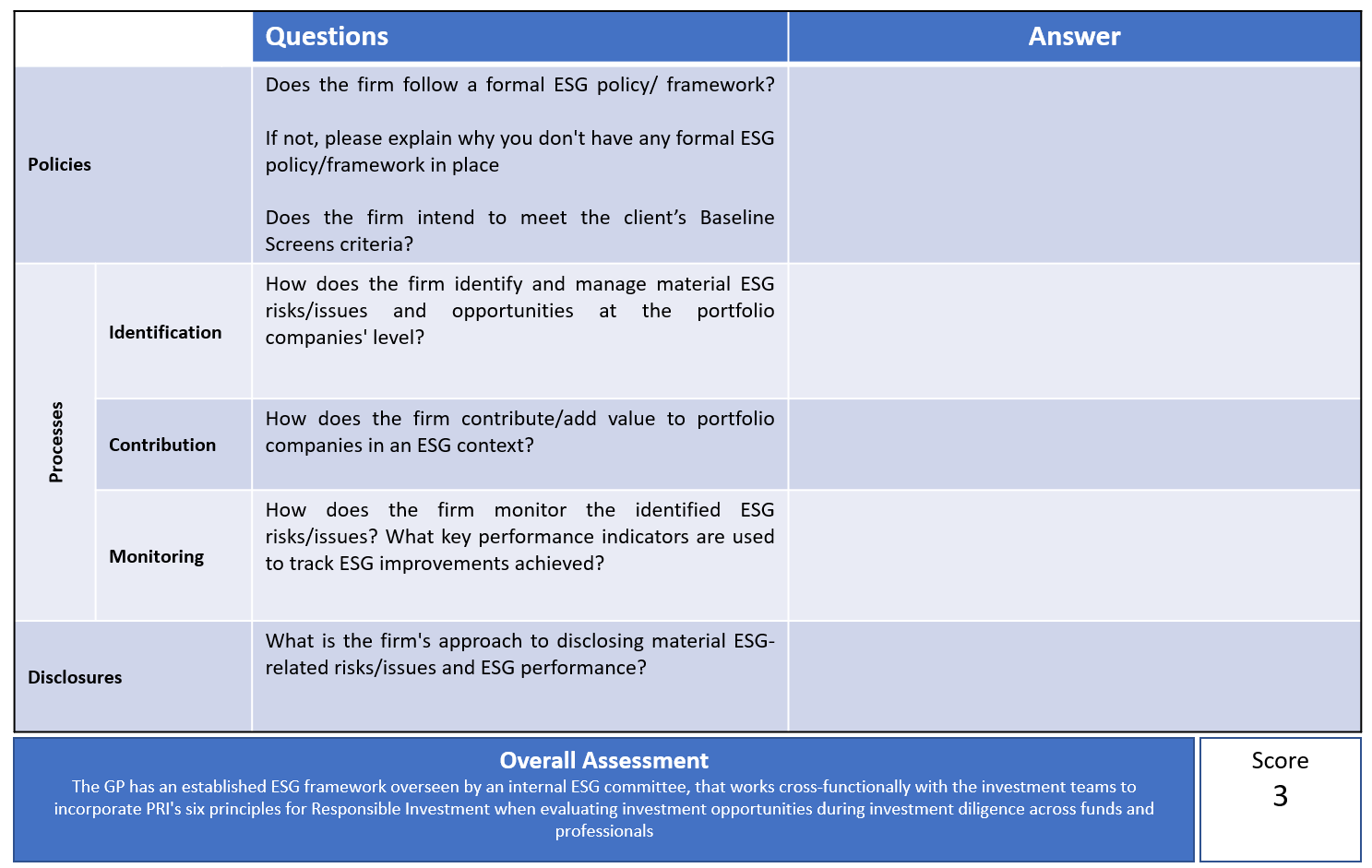

To analyze and prepare an ESG scorecard to provide an overview of the ESG policies and code of ethics followed by a particular GP.

The TresVista team followed the following process:

Data Gathering: Read through all the data available in relation to the ESG

Screening: Determined the relevant and material data for the scorecard

Analysis: Answered the questions prepared in the template

Score: Based on ESG integration and management by the GP, a score was determined to assess its practices

The major hurdle faced by the TresVista team was the limited availability of data about ESG considerations and policies. Some of the GPs did not disclose their ESG policies which limited the scope of the scorecard.

The TresVista team overcame these hurdles by reaching out to the client to obtain the latest database, while conducting desktop research to identify and assess the importance placed by the GP in its firm and portfolio companies.

The TresVista team helped the client to decrease their turnaround time by identifying an appropriate approach to complete a wide range of diligence to match client deal flow. The team also helped the client in carrying out diligence across a broad spectrum of impact areas to identify specific opportunities and problems.