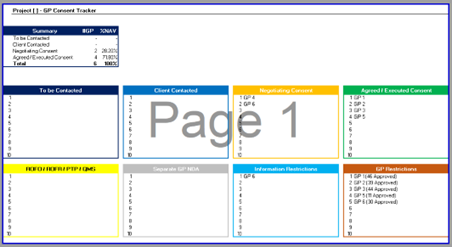

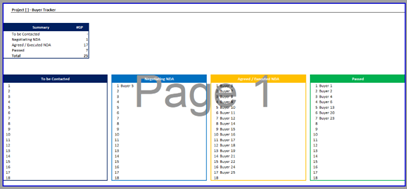

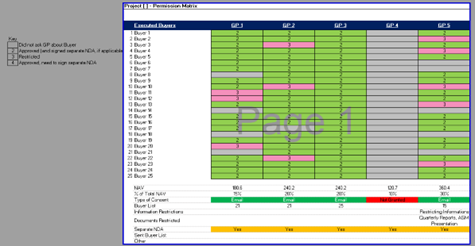

The client, an Investment Bank, wanted the TresVista team to update the deal tracker, and track GP consents, buyer permission status, and buyer engagement based on conversations of the client with the GPs and the potential buyers, over the period of the marketing stage. The client further requested the team to maintain an inventory tracker and manage the client Data room by renaming, redacting, and organizing documents received from a seller within VDR to help buyers in their due diligence process. The client also sought assistance to update the portfolio summary with the latest cash flows and conduct a public analysis to help the seller get a fair idea of the current market mentality.

To provide deal assistance on the sale of a portfolio with NAV of circa. $1.8bn and understand how a portfolio of funds is marketed and traded to get the best possible price.

The TresVista team followed the following process:

The major hurdles faced by the TresVista team were:

The TresVista team overcame these hurdles by relaying to the client before updating the deal tracker, the general geographic dynamic of the portfolio and deciding the hours at which subsequently client and TresVista analyst will update the tracker. For large inventory datasets, the team uploaded documents necessary for due diligence, and usually held on to upload legal documents which were generally required post buyer deciding stage. As such the seller’s identity remained confidential and if any legal document was requested by any buyer, the same was processed and shared with the concerned party. The portfolio was closely monitored as the funds drop off from the sale of portfolio or late additions were made.

The TresVista team added value by suggesting sorting VDR inventory folders by date rather than names of the GP to avoid delinquency in manual uploads of follow-on inventory. The team created the Buyer Interest Matrix that would track buyers’ willingness to bid for the desired funds and help track the incoming bids before the deadline. The team also introduced dynamic updates in the final deliverable which allowed for multiple tab revisions by inputting one entry. The team layered the inputs of complex formula (instead of embedding) to make the output more dynamic for the client.