The Context

The client, an Investment Banker was conducting a transaction to refinance the debt of a company in the Artificial Intelligence industry. The public company wanted to financially restructure itself to expand in North America and to manage its debt instruments better – it had 31 loans which provided administrative challenges. The company was to refinance all of its current debt to mezzanine. The client wanted the TresVista team to tailor this deal to suit the needs of multiple stakeholders. Since the output was to be customized for approaching different investors, the clients required the team’s support over and above the usual investment documents – such as the transaction comparables, CIM, and a one-page summary.

The Objective

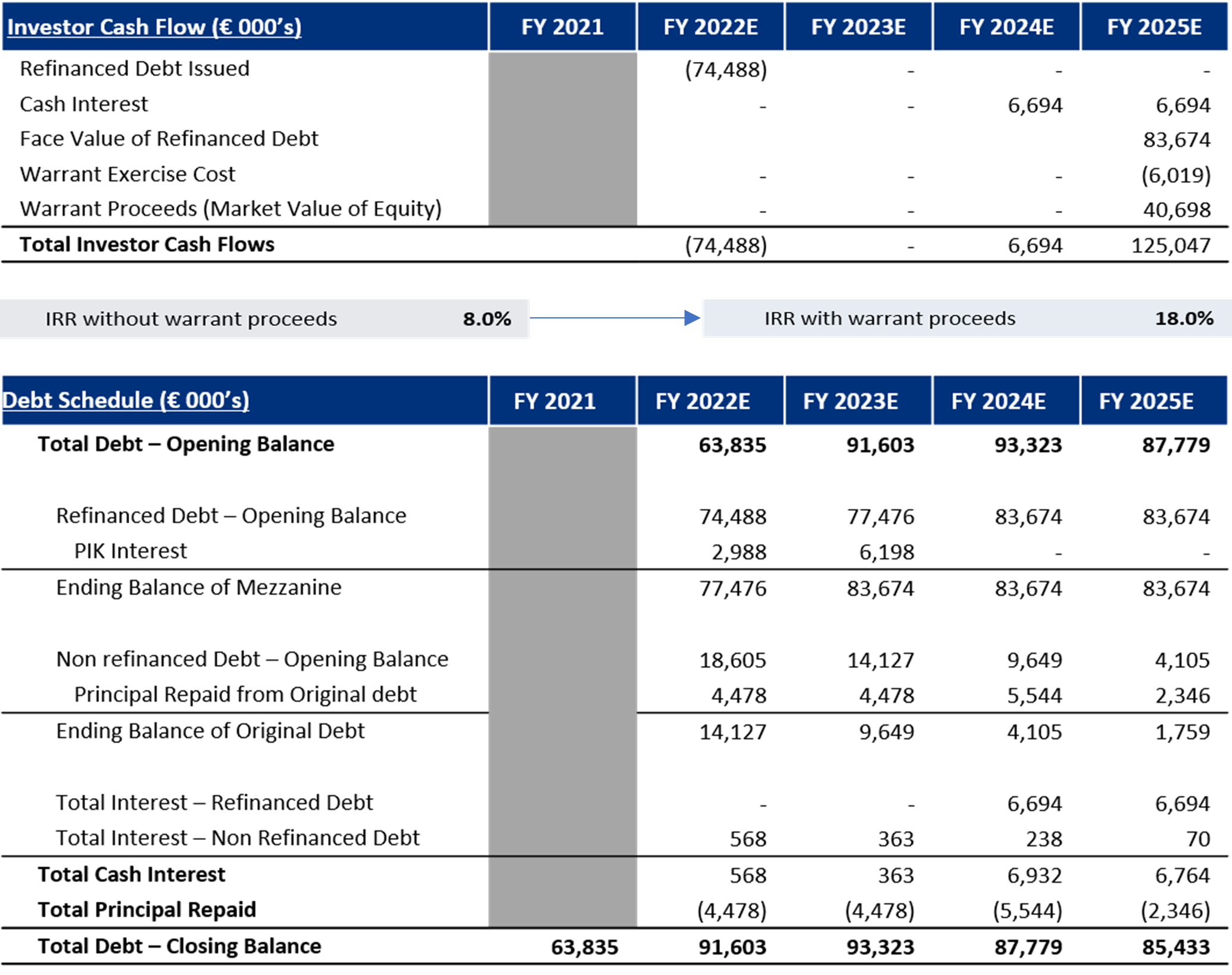

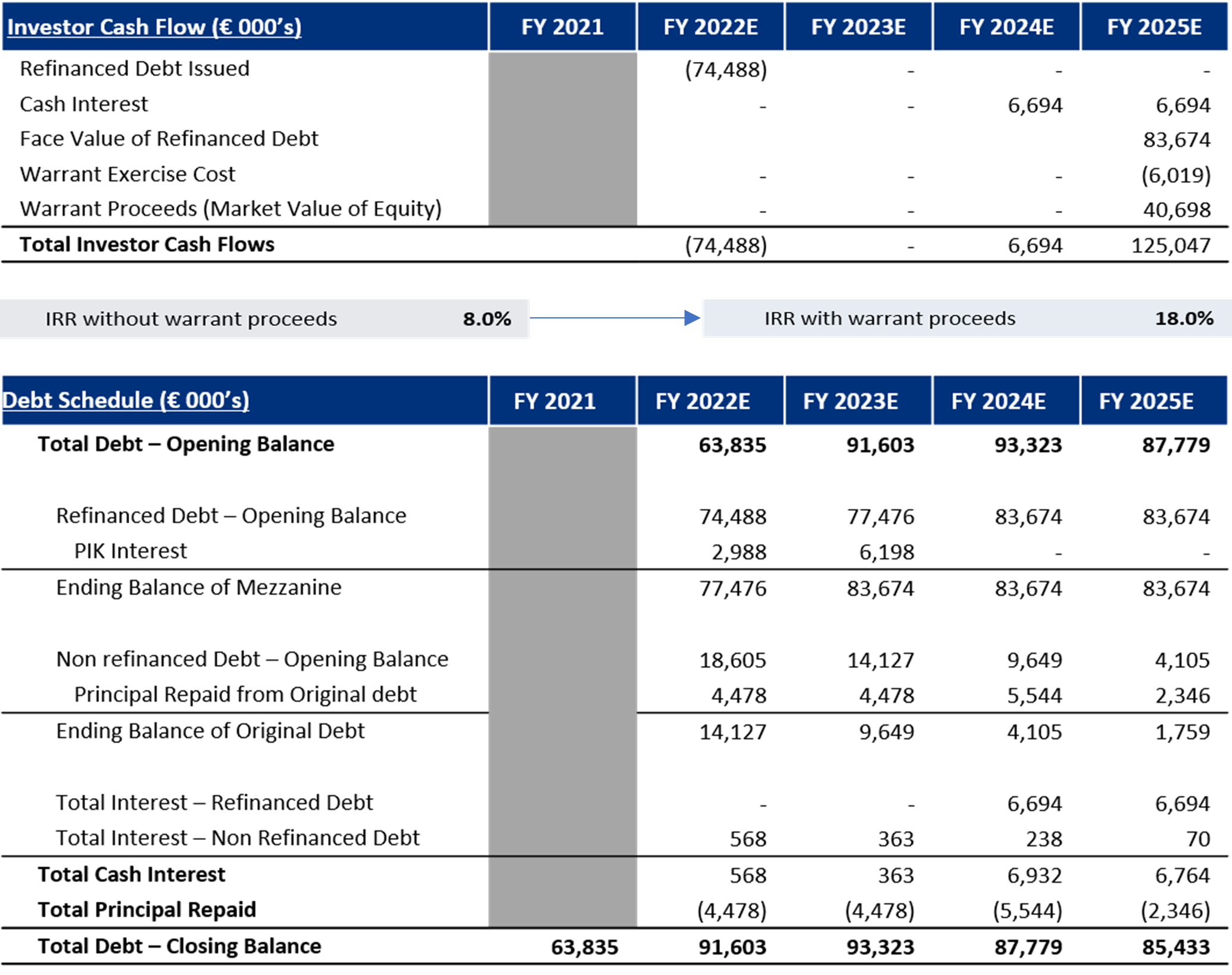

To create a financial model for raising debt and calculating warrants to be provided to investors due to the high risk associated with the debt.

The Approach

The TresVista team followed the following process:

- Aligned the company business plan to the US GAAP

- Created the key elements of the financial model

- Performed valuation analysis which indicated target company was undervalued compared to its peer comps

- This implied a significant equity upside possibility which resulted in the addition of warrants, boosting investor IRR

- Achieved the strategic goal of improving the company’s cash position

- The final output was provided to the IB to reach out to investors with custom scenarios

The Challenges We Overcame

The major hurdles faced by the TresVista team were:

- Ensuring the company had sufficient cash reserves to expand to North America while minimizing the fresh debt needed to be raised

- High returns were demanded by the investors due to the risk and complexity of the transaction

- Representing the complex components of the model in a simple way that captured investor interest

The TresVista team overcame these hurdles by ensuring the components which made the transaction complex were suitably separated into the Warrant calculations, Debt Schedule and Loan Summary tabs. Post building the necessary tabs, various iterations were tried to arrive at the PIK duration and the number of Warrants to be issued.

Final Product (Sanitized)

The Value Add – Catalyzing the Client’s Impact

- The TresVista team separated and detailed each key element into the following sections:

- Loan Summary: Listed each loan with refinance option

- Debt Schedule: View of refinanced loans and options of PIK interest duration

- Warrant Calculations: Equity valuation and warrant calculations assumptions for IRR

- Summary Output: Scenarios for warrant coverage, investor IRR and cash position

- Modelled PIK interest for the first two years to save cash for the company

- Provided warrants which captured the equity upside of the company post financial turnaround, ensuring investors achieved their desired IRR