The client, a Private Equity firm wanted the TresVista team to commence the portfolio summary exercise to get a quick understanding of the top contributors (both by way of assets and funds) and their aggregate exposure. For this, the client sent over the deal details to be logged on their database and provided a data room for the sale portfolio. Once the deal entered the LOI stage, the team was required to conduct a bottom-up financial due diligence on the top assets of the major funds.

To facilitate end-to-end financial due diligence on one of the biggest LP deals led by the client.

The TresVista team followed the following process:

The major hurdles faced by the TresVista team were:

The TresVista team overcame these hurdles by leveraging expert calls and knowledge from previously underwritten deals/funds. The client provided an industry-pertinent outlook for the assets, which helped the team to manually assign a secondary uplift based on the assets’ returns to date. Additionally, the team developed a standard approach to interpret information from the GP reports of the previously underwritten funds. Moreover, the team periodically reached out to the deal team for additional discussions.

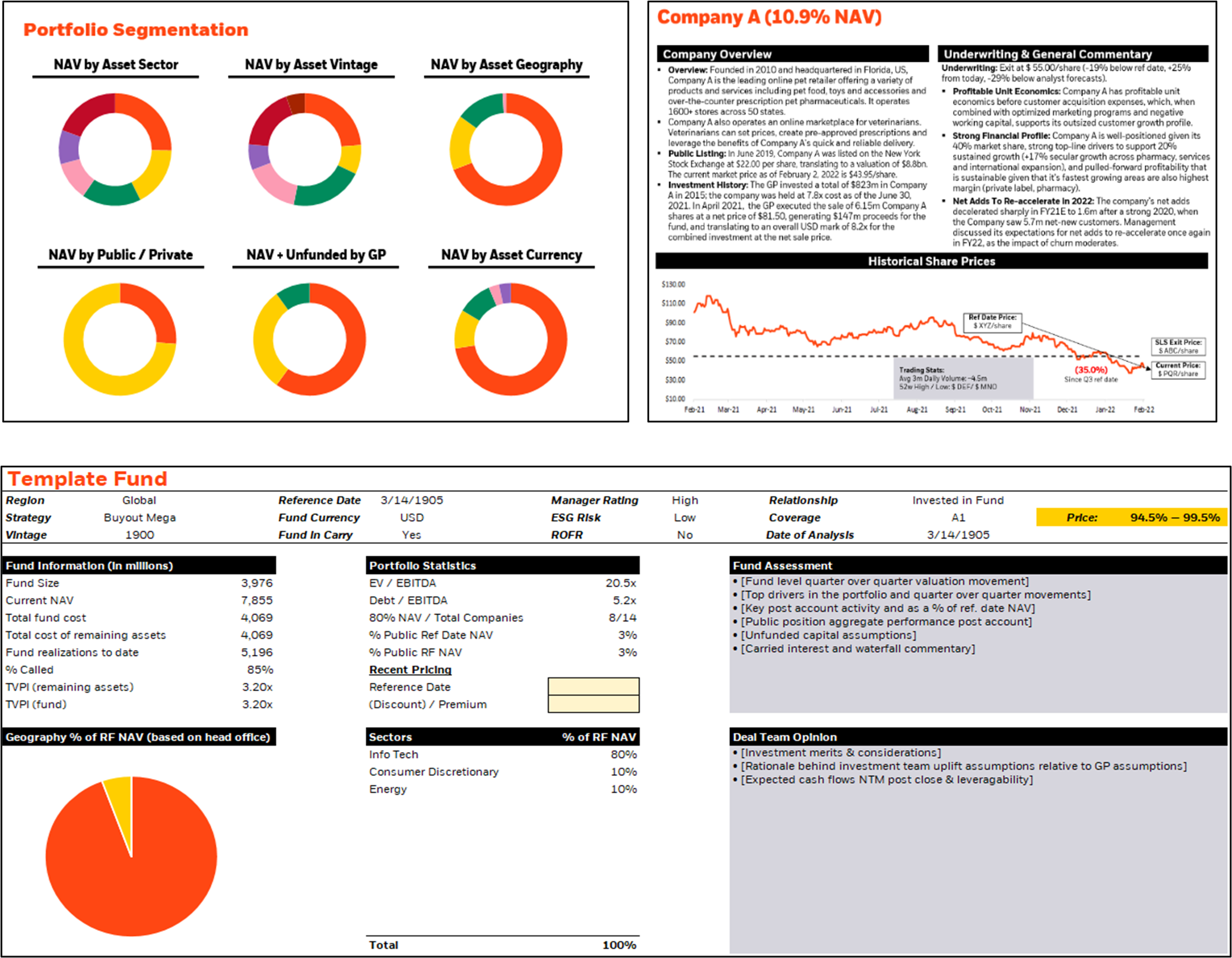

The TresVista team built an automated portfolio summary excel file for the client containing the top contributing assets, which helped them classify and analyze their portfolio based on vintage year, geography, industry, currency, etc. Additionally, the team incorporated individual fund tabs with asset-level details to build a panorama across the entire portfolio. The team also developed full-fledged secondary fund models, which in turn helped the client arrive at lucrative pricing and construct an effective deal structure.