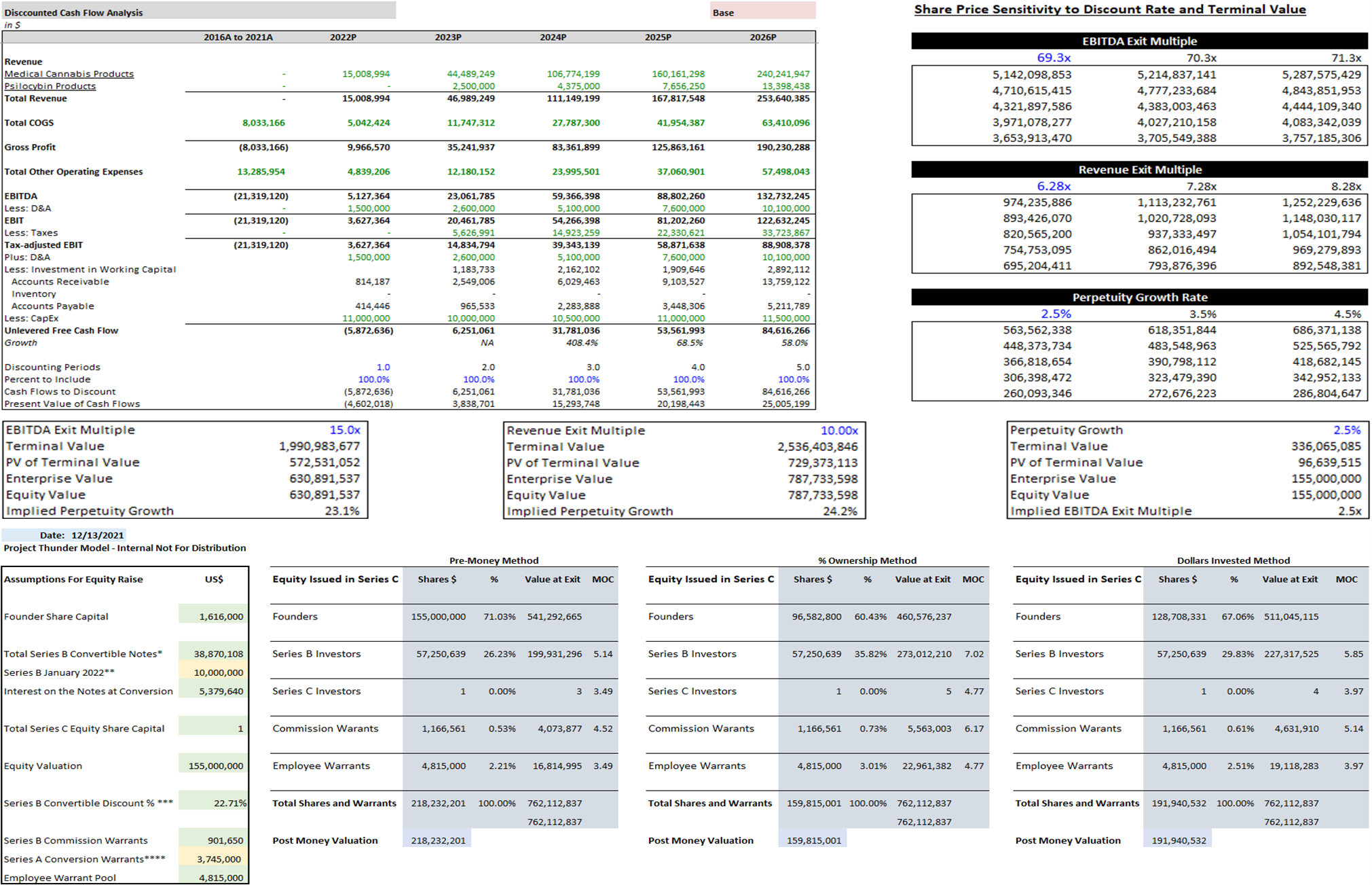

The client, a Venture Capital firm wanted the TresVista team to create a DCF model for a Medicinal Cannabis business with the ability to run sensitivities and to build various cases to determine how valuation is affected under a given set of assumptions. Further, the client was looking to analyze the founders’ equity stake in the company post-conversion of convertible notes by using Pre-Money Method, Post-Money Method, and Dollars Invested Method. Moreover, the client also wanted the team to create investors’ rights agreements and warrant amendment letters to issue new shares to each investor based on the valuation from the DCF model.

To create an easy-to-understand and dynamic DCF model to cater to the client’s expectations.

The TresVista team followed the following process:

The major hurdle faced by the TresVista team was to help the client comprehend the model’s approach and mechanics by devoting considerable time. The valuation arrived was significantly higher compared to industry standards, which resulted from the overly optimistic growth projections of the Free Cash Flow provided by the client.

The TresVista team overcame these hurdles by organizing regular calls with the client, explaining the approach, and creating a model guide to explain the flow and functioning of the model. As for the inconsistency in projections provided by the client, team discussed various outcomes on calls and efforts were made to reach a consensus on making the projections more realistic.

The TresVista team created a detailed model guide and highlighted the key input for the client, which helped to update the valuation. Moreover, the team also incorporated placeholders for line items in the model that might be required in the future (for instance, working capital requirements, debt, etc.).