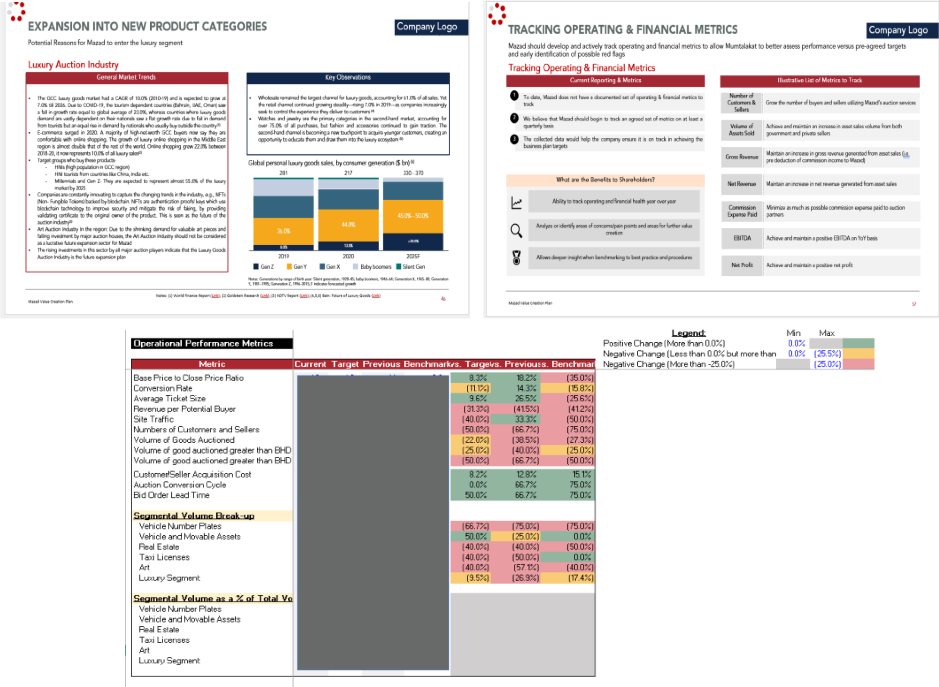

The client, a Private Equity firm, wanted the TresVista team to develop a system to efficiently track the performance of its portfolio company and develop strategies for unlocking the growth potential of the company. The client wanted the team to research the company’s global peers’ operating and business models, followed by market research about expansion into the luxury auction industry, and develop a KPI tracker.

To build a performance tracking system for the client’s portfolio company and develop strategies to unlock the company’s growth potential.

The TresVista Team followed the following process:

The major hurdle faced by the TresVista Team was the unavailability of information on the segments in the annual reports or through analyst research. The team overcame the hurdle by conducting extensive research about the industry via deep diving into various peer company reports and understanding the market’s historical trends.

The TresVista Team conducted exhaustive research on the luxury auction industry and its major challenges. The team also showcased how different portfolio companies can collaborate for greater synergy. The tracker devised by the team helped the shareholders and the management monitor performance on a product-wise basis and varying periods (monthly, quarterly) for better alignment with expected performance.