The client, an Investment Bank, asked the TresVista team to summarize bids for the sale of a company, including research on potential buyers for the outreach process, modeling the disparate bids into a model to facilitate comparison for valuation purposes and creation of a consolidated presentation deck for better understanding of the offers received.

To build a bid summary model to analyze and represent various bids in terms of multiples and valuations offered to the client.

The TresVista team followed the following process:

• Research: The team understood the client’s business, created a preliminary buyer’s pool to send the outreach mails to, researched on buyer’s investment criteria and industry focus, and streamlined to a core set of buyers to send the outreach mails to

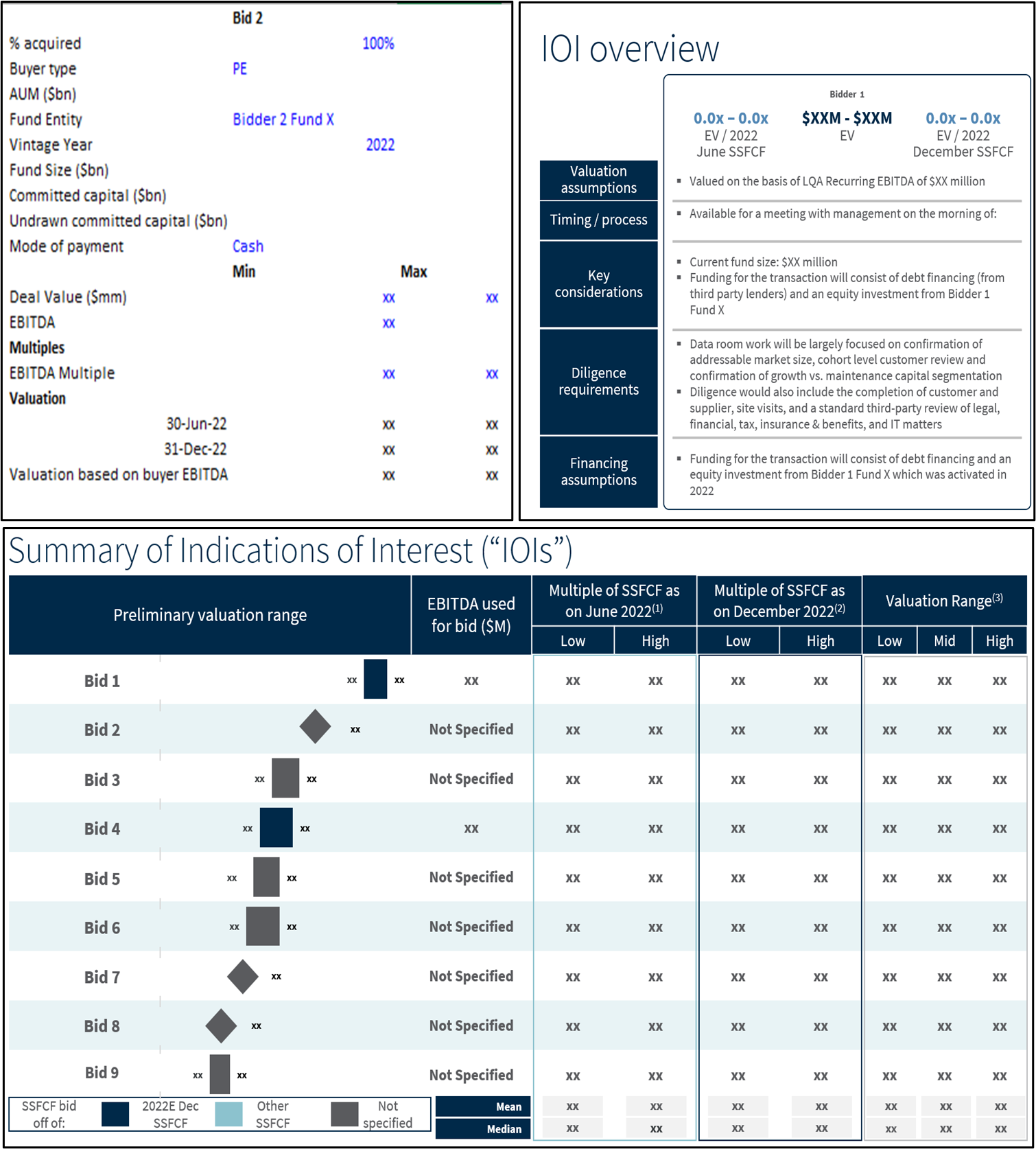

• Valuation: The team comprehended the valuation of each buyer stated in their respective IOIs (Indication of Interest), prepared a base model considering all the valuation multiples and covenants mentioned, and summarized the implied EV resulting from the said multiples

• Analysis: The team standardized various multiples provided, such as, converted a bid received in ARR multiples to EBITDA multiples, compared various implied EV, ARR and EBITDA multiples to identify viable offer

• Representation: The team finally prepared comprehensive presentation consolidating all the offers presented with the help of graphical exhibits and detailed buyer profiles

The major hurdles faced by the TresVista team were:

• Magnitude of buyers in the tech-space given the boom witnessed by the industry in recent years

• Analyzing each PE sponsors’ distinct approach in valuing and presenting their opinion on the asset offered

• Standardizing the multiples across bids to provide the client with uniform data

• Urgency of the request due to the push from the client to close the deal

The team overcame these hurdles by identifying peer companies in the sponsor’s portfolio to evaluate the best fit and creating distinct models in real-time as and when the bid was received. The team tried to understand the metrics and the steps included to create them, to arrive at the resultant multiple.

The TresVista team suggested the entire bid model by leveraging the practices applied by a peer team for their client. The team also provided a checklist of primary valuation multiple driving the bids to help understand the strategic motives of the buyers along with the addition of Due Diligence requirement mentioned on IOIs highlighted in the buyer profiles.