The client, a Private Equity firm, wanted to perform Sum of the Parts (SOTP) valuation for various segments of the target company. Based on the SOTP valuation, the client wanted to run an Accretion/Dilution analysis to understand and evaluate the effects of acquiring the target company and merging it with the parent company. The approach for the acquisition was strategic, and the client was primarily interested in one of the equity investments that the target company had invested into.

To perform a SOTP valuation for various segments of the target company along with an Accretion/Dilution analysis. Also, perform a performance benchmarking exercise to facilitate comparison of the target and the acquirer.

The TresVista Team’s primary focus was to decide the valuation method for each segment based on the nature of the business. The TresVista Team then:

The information pertaining to the segments was not readily available in the annual reports. The TresVista Team had to spend a considerable amount of time researching the assumptions for revenue growth and occupancy. To overcome this hurdle, the TresVista Team connected with the client to understand the assumptions desired for the model. The client also provided the trading results for the hotel, which had information related to the companies.

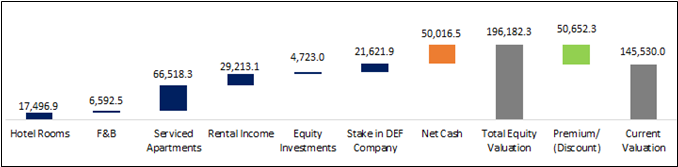

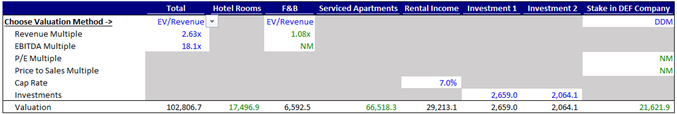

The TresVista Team created a dynamic model and provided the client with the flexibility to change the inputs according to his preferences. The valuation for majority segments and stake was done in different ways and a dropdown was provided to pick the valuation method. The TresVista Team created a bridge chart to present the company’s segment-wise valuation and show the difference (premium/ discount) between the market and derived valuation.