The client, a Private Equity firm, wanted to update the platform Leveraged Buyout (LBO) model and consolidate a new add-on acquisition to see the return build-up and ratio analysis. Since a LBO transaction involves taking a lot of debt on the books, the client wanted the TresVista Team to focus and analyze the covenant levels (FCCR, Leverage ratio, etc.) to ensure that the covenants are not breached in any given year.

To update the platform LBO model and consolidate the financials of the new add-on acquisition, which would drive the returns and help in decision making.

The client shared the deal Letter of Intent (LOI) and the data room access with the TresVista Team to help them refer the relevant files.

The TresVista Team combed through the deal LOI to understand the dynamics and financing structure of the deal and updated the model in the following order:

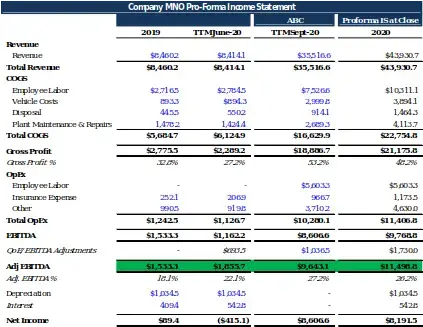

• Built the pro forma Balance Sheet and Income Statement at close for the merged entity

• Allocated the purchase price as per the deal structure and keeping in mind the leverage, equity raised, goodwill calculation, etc.

• Considered the new company’s forecasts numbers which drove the returns and checked the Ratio Analysis tab for any covenant level breaches

The major hurdle faced by the TresVista Team was to tailor the model to cater to the needs of individual lenders and investors. The TresVista Team proactively communicated with the client and the lender regarding the updates to avoid any gaps in understanding.

The TresVista Team built a comparative analysis for different cases running in the model to help compare the margins pre and post-acquisition of the new combined entity. A returns analysis for the different scenarios pre and post-acquisition, was also performed. The TresVista Team helped the client streamline the acquisition modeling process for all add-ons and developed a defined structure for future acquisitions. This made the whole process simpler and more structural for the client. With the TresVista Team managing the entire task right from the start, the client could focus their time on other significant due diligence workstreams like legal, operational, environmental, etc.