The client, a Hedge Fund, asked the TresVista team to assess whether US commercial REITs showed signs of vulnerability in response to the recessionary and rising interest rate environment. The team was also asked to create a streamlined method to screen the entire US REIT market and monitor it on a daily basis, analyze the primary stakeholders in the domain and identify the triggers for them to sell and evaluate the valuations within this domain and identify potential short opportunities.

To assess whether US commercial REITs showed signs of vulnerability in response to the recessionary and rising interest rate environment.

The TresVista team followed the following process:

• Understand the REIT space: Conducted research on the operations of REITs, key metrics and valuations

• Develop a dynamic screener: Developed a customized screener to track the REIT space on a daily basis

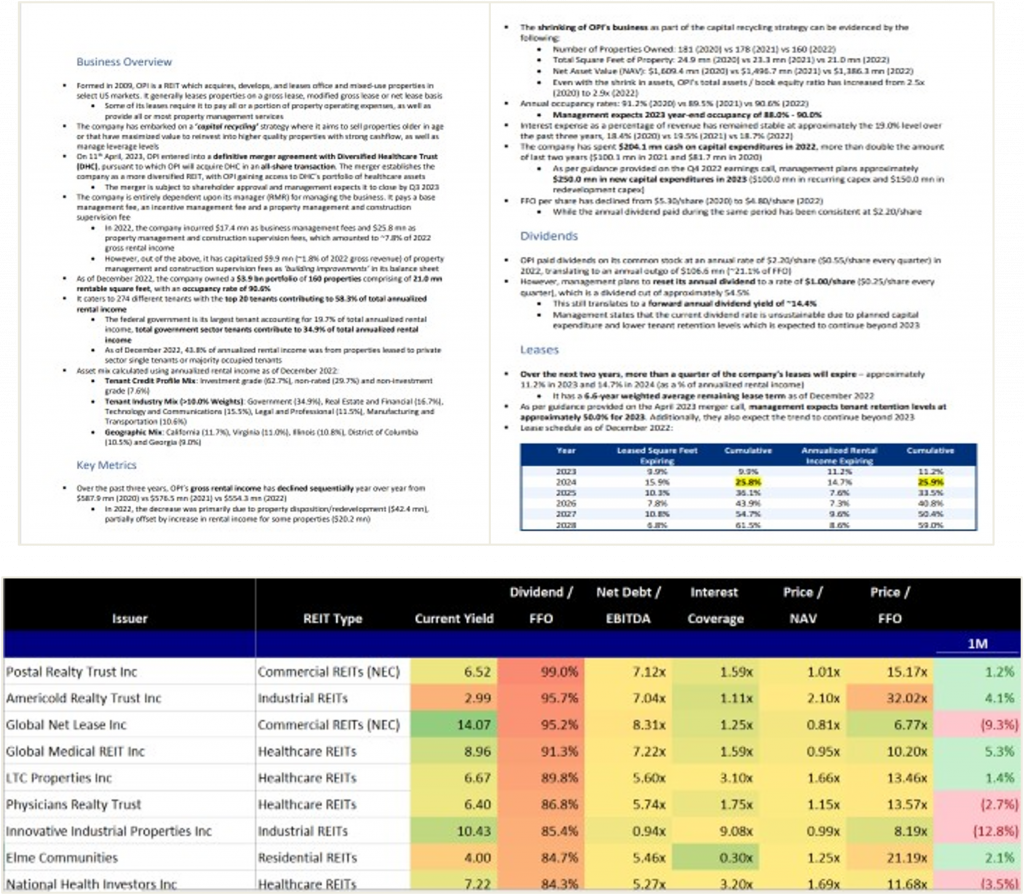

• Evaluate the REITs based on metrics: Leveraged the screener to evaluate REITs with unsustainable dividend payouts and high leverage

• In-depth analysis and research of select REITs: Conducted in-depth research to analyze the fundamentals of the REIT and evaluate a potential short opportunity

• Formulate research notes and an opinion on the REIT: Formed an opinion on the REIT and summarized our findings in the form of a research note

The major hurdles faced by the TresVista team were:

• Developing a deep understanding of REIT fundamentals, market trends, and industry dynamics, essential for accurate analysis

• Narrowing down the entire US REIT universe of over 500 REITs by taking the top 8 REIT ETFs in the US as our addressable universe

• Ensuring the accuracy and consistency of data pulled from the database and developing a dynamic screen that can be updated

• Interpreting the results of the screener and distilling them into actionable insights

The team overcame these hurdles by deep diving into the sector to understand the REIT fundamentals, market trends, and industry dynamics. To create focus in the analysis, the scope was narrowed to include all the REITs of the top 8 US REIT ETFs. This way the team’s resources were dedicated to the most relevant players in the field. Since the screener was leveraged to initiate the research, data accuracy became paramount. The TresVista team ensured the accuracy and consistency of data pulled from the databases. Additionally, a dynamic screen was developed that could adapt to daily market changes and alert the team to emerging opportunities and risks. Results of the screening process were distilled into research notes that the client could act upon.

The TresVista team integrated essential metrics such as Div/FFO data, short interest data, debt maturity schedule, and various liquidity coverage ratios into the screening process and conducted an in-depth analysis of short interest data with a focus on identifying potential short squeeze opportunities. An analysis of a REIT in the process of a merger was presented, providing insights into the transaction and the unfavorable fundamentals of the target and the acquirer. As a final note, the team highlighted that despite certain REITs displaying vulnerabilities, taking a short position might not be advisable due to their substantial dividend yield.