The client, an Investment Banking firm, asked the TresVista team to analyze valuation trends in both public and private markets across suitable FinTech sub-sectors. Request also included conducting regression analysis, an alternate method to estimate the valuation range for a company. The IB client had an end client, a FinTech company seeking to get acquired either by a larger FinTech (strategic) player or a financial buyer.

To analyze valuation trends in both public and private markets across suitable FinTech sub-sectors.

The TresVista Team followed the following process:

• Identified two appropriate sub-sectors the company could be bucketed under

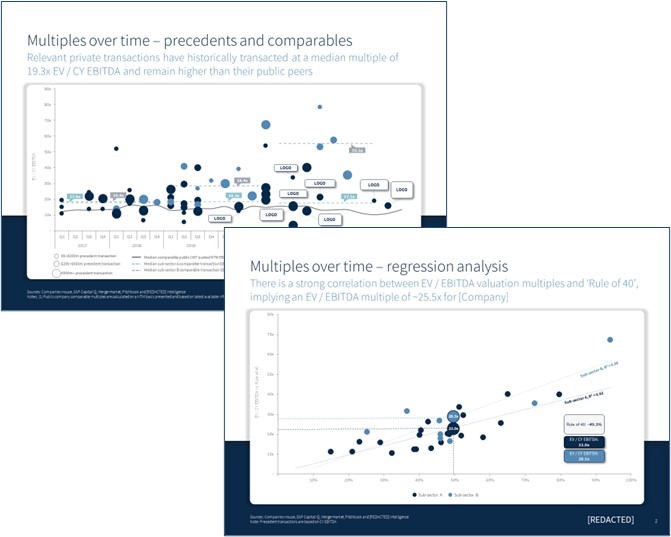

• Public trading data (CapIQ) and private transaction data (proprietary database) over the last ~6 years was plotted on a comprehensive chart for valuation trend analysis

• Sub-sector A had higher valuations than sub-sector B, indicating that the company should be positioned as a company from sub-sector A in order to attain higher valuations from competing bidders

• Similar exercise was conducted using a regression analysis on select transaction data to find out the best positioning for the company

The major hurdles faced by the TresVista team were:

• Limitations in finding relevant transaction details along with required KPIs (revenue growth & EBITDA margin) as the information is not easily publicly disclosed

• Duplication of transactions across multiple sectors. The template was initially unable to classify them as separate transactions while forming the output

• Tight deadline and quick turnaround for the project along with the involvement of multiple requestors on client’s end and modifying the template as per their individual comments

• Representation of the required data on the presentation slides because of multiple legends and data labels

The team overcame these hurdles by work arounds such as disabling CapIQ at certain instances as well as working on only certain parts of the file at once was necessary to handle the Excel file. For transaction data, the team leveraged TresVista’s proprietary database as well as the client’s relationships to fill in missing values.

The TresVista team fully automated the Excel template, any new user just needed to add the backup data in the deals tab, post which the final outcome of the bubble chart, regression analysis, and precedent comps would be automatically generated. Initially the team had built the analysis slides on both revenue / EBITDA multiples for the client to choose which method can lead to a higher valuation for their company. The team also compared the public multiples to the precedent deals to showcase that the private companies are backing the stronger valuation game.