The client, a Private Credit firm, asked the TresVista team to build a fund model with the help of a comprehensive set of assumptions provided by the client that translates their sustainable investments strategy. The purpose was to facilitate investors analyze the fund cashflows, and investor returns at the end of the investment period from the direct lending fund (DLF), hence aiding their fundraising process. The fund focuses on public, private and syndicated debt investments in high quality, lower risk sustainable borrowers, which are facilitating the transition to a low carbon economy (ESG). The inputs shared at the fund level included equity contributions, debt ratio, fund life, commitment period, fund expenses, capital recycling, hurdle rate, management fees, ESG fees and GP carried interest as per the European Waterfall structure. The inputs shared at deal level included specific assumptions for availing debt like interest margins, upfront, origination & exit fees, and annual amortization rates of loans.

To build a fund model that translates the clients’ sustainable investments strategy.

The TresVista Team followed the following process:

• Creating a loan deployment schedule: Tracking the timeline of each prospective investments, credit ratings, interests, fees, and amortization rates; shows the portion of invested and recycled capital in investment

• Loan Schedules: Individual schedules for each loan deployed; displays the periodic flows on a deal-on-deal level (basis of American waterfall); shows the total principal outstanding at any interval

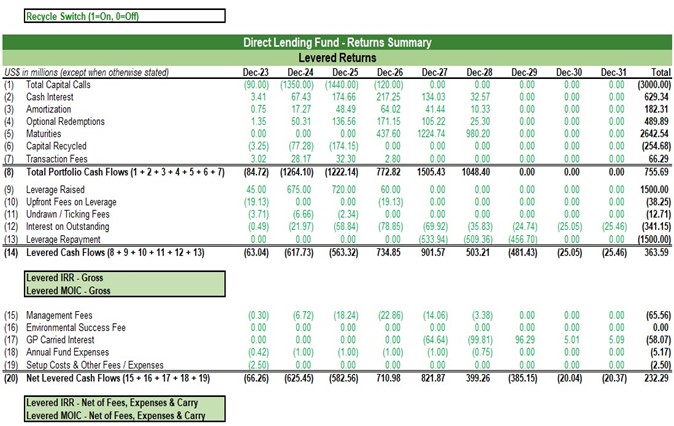

• Calculating Fund Cashflows: Total capital contributions (from LP capital and/or debt) less the take-outs of fees, expenses; remaining cash flows are used for waterfall distributions based on hurdle, catch-up, and carry assumptions; summary of gross and net IRR & MOIC at the fund level

• Evaluating levered/unlevered returns of LPs and GPs: 100% of distributions go to LPs until they receive the preferred return; catch-up fee to the GP once the hurdle rate is reached followed by carried interest basis the rate

The major hurdles faced by the TresVista team were:

• The client had asked us to incorporate both the European and American return structures in the same fund model to analyze the investor returns in both the scenarios. Since the American waterfall structure calculates returns on a deal-on-deal basis we had to create individual loan schedules for each investment made or deployment

• The file size became too large and led to slower performance and calculations. This is because of multiple complex excel formulae were being run simultaneously

The team overcame these hurdles by enabling the Manual Calculation mode in Excel. When manual mode is turned on, Excel will not perform calculations until F9 is pressed. The Automatic Calculation mode will make Excel do calculations automatically and that can slow down the Excel speed to a great extent.

The TresVista team created the fund model in such a way that it will fundamentally help draft the PPM through quantifiable data, hence bridging the expectation gap between founders and investors. This base model will also serve as a template for the client’s upcoming funds.