The client, a Private Equity firm, asked the TresVista team to put together a variance analysis for its expenses and revenue from GL accounts to determine the company’s current financial health. The request was to analyze income and expense variance over month-to-month and on a year-to-date basis.

To perform variance analysis for the revenue and expenses accounts to determine the financial health

The TresVista team followed the following process:

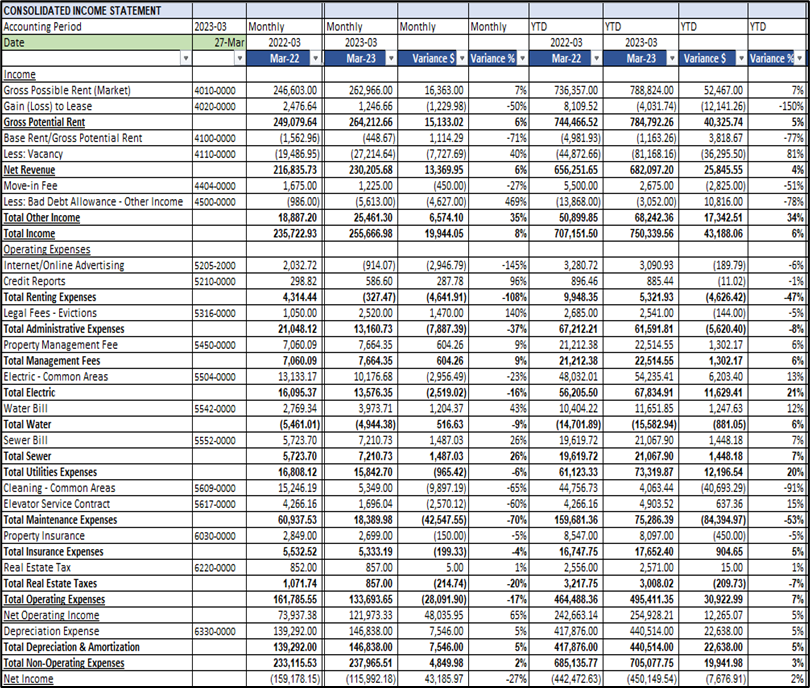

• Prepared a consolidated income statement analysis from the trial balance which included all the revenue GL accounts followed by expense GL accounts

• Created different tabs for each property since one portfolio has multiple companies. Each property had independent income statement which was further analyzed

• Prepared a tab called the ‘GL Drilldown’ as there were recurring expense GL accounts. A similar tab to track utility expenses was also created

• Caught the unusual changes in the GL accounts at the property and investigated for reclass or noted as one-time expenses

The major hurdles faced by the TresVista team were:

• To understand the process of the client since it was manual and time consuming

◦ The major hurdles caused by this process for the team was difficulty in chasing the AP Utilities team and the vendors as it can be an elaborate and time-consuming process

• The increase/decrease in usage was not always explained by just running the GL. The maintenance team had to go to the property to inspect the change which was time consuming

• Spent time in understanding the complex schedules prepared at the client’s end to investigate the reason of the variances further

The team overcame these hurdles by automating the template by including various checks, value filters, and conditional formatting to perform the task of income analysis more efficiently and effectively. A Utilities tracker was created to make note of any ongoing investigations that might be taking place at the properties which were having a significant spike in usage. The AP Utilities tracker played a pivotal role in helping the client as well as the other team members in saving costs as it helped them to spot the properties having leakages more quickly. Therefore, the client was able to conduct inspections in time, which reduced their losses from $5 million to around $1 million. With this process, the TresVista team was able to cut down 7-8 days of work of Income Statement analysis to 3-4 days.

The TresVista team was able to identify any increase / decrease in usage due to leakage or damaged utility tracker meters at property was caught in the process and fixed. Charges which were over-charged than the monthly recurring expenses were spotted, and the team was able to chase the vendors within time to get them rectified for incorrect charges, if any. The high-volume data was simplified to enable its analysis and enhancements in every aspect of the process. The way helps in consolidating the recurring expense accounts in ‘GL Drilldown’ and ‘Utilities’ tab, and also helps in clearing off the air between the non – recurring accounts.