The client, a Hedge Fund, wanted the TresVista team to create NAV and reconciliation packages for funds monthly. The client provided the Administrator’s data, including asset details, financials, and cash movement data and wanted the TresVista team to reconcile the accounts and financials not booked in the software.

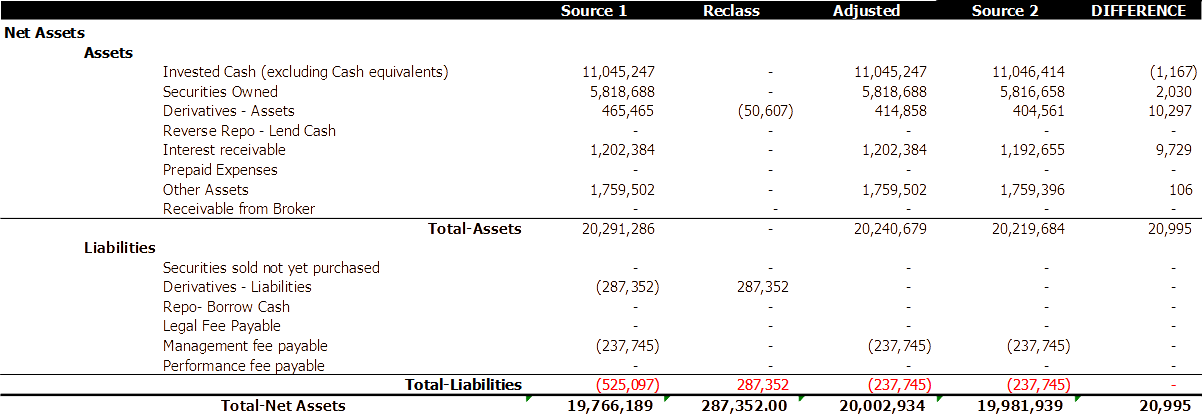

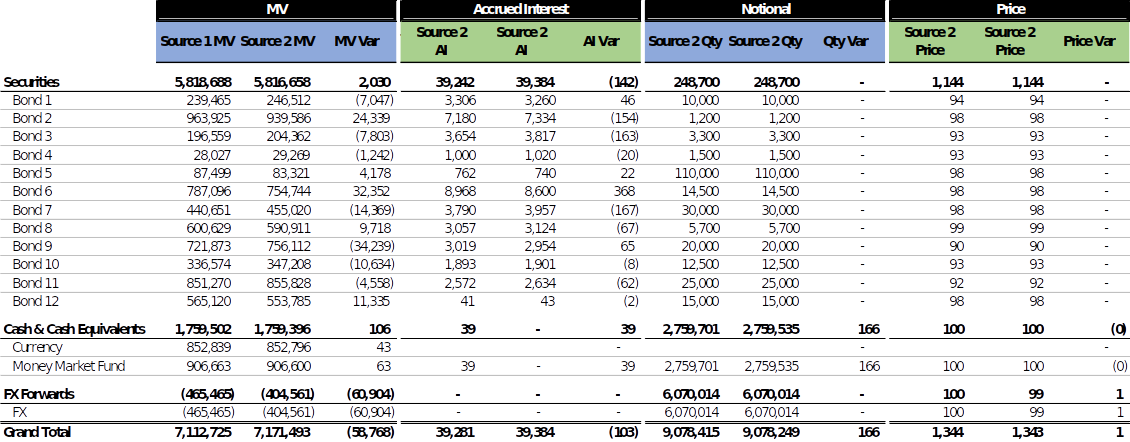

To make entries and updates for the transactions that were not booked in the accounting software and perform a root cause analysis for the variances between the accounting books.

The TresVista team followed the process as below:

Gathering Data: Gathered financial and accounting data from relevant sources

Sanitization and Validation: Cleaned and processed the data to the client format

Analysis: Analyzed the variances to determine the root cause

Reconciliation: Posted adjustment entries for reconciliation and provided reasons for discrepancies that weren’t reconciled

Publishing NAV Package: Uploaded the reconciled accounts and the analysis to the client portal

The major hurdle faced by the TresVista team was comprehending the reasons for the discrepancies. Since such discrepancies could originate from either of the accounts, thorough investigation of the transactions was conducted. The date, time, and source of variables in the Administrator’s and client’s books differed, causing variances in the value of the assets.

The TresVista team overcame these hurdles by comprehending the real-life hurdles faced in trade capture and settlements and familiarizing with various tools and reconciliation methodologies used in shadowing accounting practices by Hedge Funds. In-depth knowledge of the instruments like bonds, CLOs, Swaps, Forwards, Futures, and the accounting practices followed for these instruments was acquired by the team along with developing expertise on the SS&C tools like Geneva and Recon.

The TresVista team helped reduce the turn-around time for the client in publishing the final NAV reports for their investors and the analysis conducted could be utilized by the client on other funds with similar breaks. The team developed techniques and methods that could be followed to complete the extensive and time-sensitive project within designated time.