The client, a Growth Equity firm investing majorly in enterprise technology and healthcare companies across North America, wanted to analyse the historical performance of a company with a subscription-based business model. The goals of the project were to help the client better prepare for the management meeting and analyze the investment potential of the target.

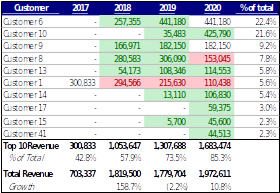

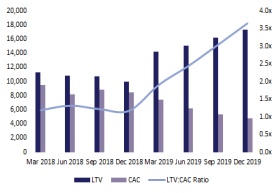

To understand the performance of a B2B Software company in terms of the quality of revenue, trends in customer concentration, customer acquisition costs, and the effectiveness of the marketing spend.

The due diligence process was divided into three buckets based on the following types of analysis:

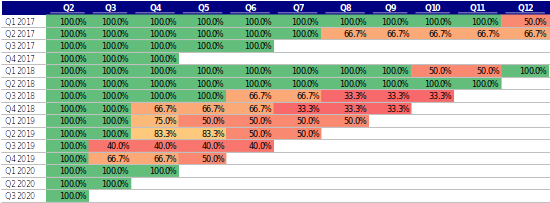

• Cohort Analysis

• Revenue by Customer Analysis

• Unit Economics Analysis

The TresVista Team also covered industry-specific metrics like:

• Monthly Recurring Revenue (MRR) and Annual Recurring Revenue (ARR)

• Revenue and Customer Retention by Cohort

• Lifetime Value to Customer Acquisition Cost (LTV/CAC)

The TresVista Team provided the client with an overview on how the target company has managed to retain both its customers and revenue. The performance of customer cohorts and the concentration within the customers were the key areas of focus. Based on the findings, red flags and certain points that required further diligence were highlighted.

While conducting due diligence, the TresVista Team found that some companies did not provide their revenue split in a structured manner, with some having just a basic pull from their respective CRMs. Organizing data in a way that could then be analyzed insightfully was a major hurdle.

The TresVista Team cleaned the data provided by management to make it consistent across line items and periods and skimmed through existing customer contracts to fill the gaps.

• Analyzing a subscription-based business runs deeper than analyzing its top line performance and profitability

• An understanding of customer dynamics such and how sticky they are, reveals a great deal about the business

• Importance of understanding the effectiveness of the marketing spend

The TresVista Team built a template referencing this output which was used to evaluate all target companies, thereby making this deliverable an integral part of the client’s due diligence process. The project helped the client to evaluate incoming deals more systematically and take decisions based on meaningful data.