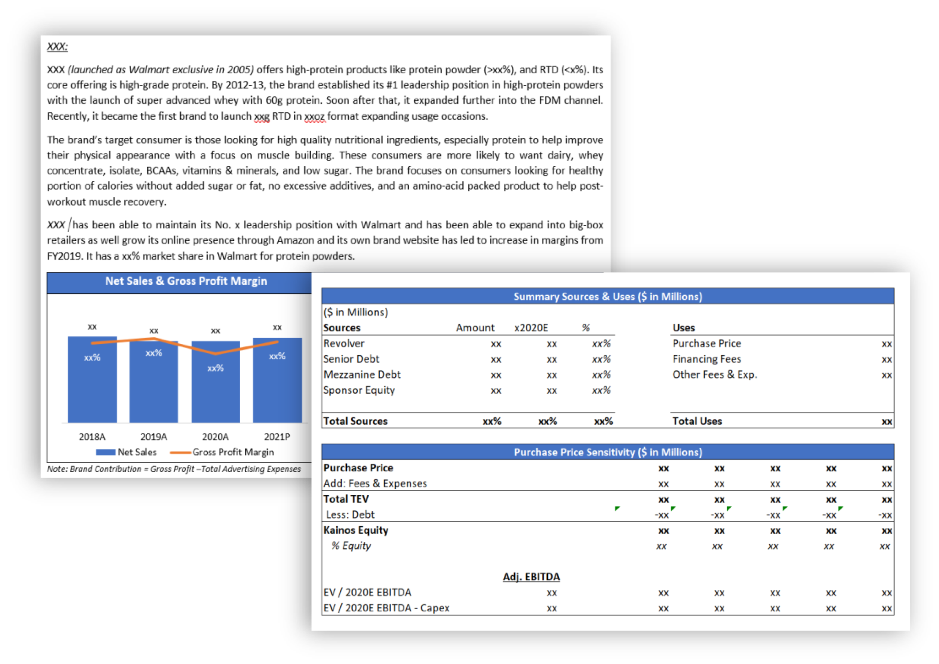

The client, a Private Equity firm, wanted the TresVista Team to create a detailed IOI Memo of an inbound CIM detailing an investment opportunity of a carve-out of three U.S.-based protein brands from a leading nutrition company. The cient wanted a company overview, including discussions and breakdown of key channels and customers. Also, as part of their due diligence process, the client wanted an outline of the supply chain and distribution network, focusing on top suppliers and costs incurred along with third-party relationships.

To create a detailed IOI Memo of an inbound CIM detailing an investment opportunity focusing on key channels, customers, supply chain, and industry sales analysis and build an LBO returns model running on two cases.

The TresVista Team followed the following process:

The major hurdles faced by the TresVista Team were manual data entry causing stretched timelines as the CIM file was locked. Difficulty in projecting expenses, as the company did not provide Quality of Earnings. Inconsistent memo structure led to several reviews and extensive hours of research to ensure no key details were left out. The TresVista Team overcame these hurdles by establishing effective communication with the client to ensure efficient management of timelines. The team revisited the raw data in the CIM to provide structure to the document.

The TresVista Team, additionally, researched commodity price volatility on whey protein and milk-based raw material and ingredients used by the target company for their products based on the raw data provided. The findings led to a lower bid placed by the client as the commodity price volatility affected the ingredient expenditure, which constituted ~75%-80% of total COGS.