The client, a Limited Partner, wanted the TresVista Team to prepare a Quick Screen and Quant Model to get an eagle-eye view on the merits/demerits of the prospective investment opportunities, along with a historical performance analysis.

The client specializes in making fund investments sourced through proprietary deal-flow. The Quick Screen and Quant Model helps them evaluate whether the next fund of the PE firm can be an excellent candidate to take an LP position

To create a Quick Screen and Quant Model for a 360 degree analysis of a PE Firm:

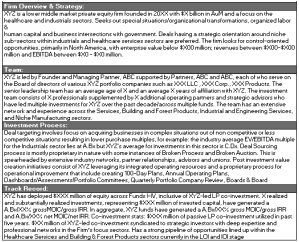

• Quick Screen: High level qualitative analysis and insights into the investment strategy, process, team, strengths, and weaknesses of the various funds of the firm

• Quant Model: High level quantitative analysis of performance of the firm’s historical funds

The TresVista Team started with an in-depth study of the sell-side materials sourced by the client for debunking the following questions:

• What are the deal sourcing and investment strategy of the firm?

• What kind of management is the firm backed by?

• What are the industry tail/headwinds?

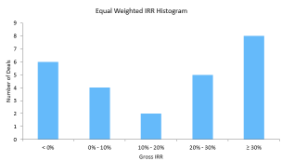

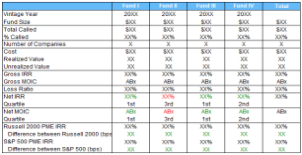

• What is the quantitative historical track record of all funds managed by the firm?

In the final deliverable, the TresVista Team shared insights into the features and niches of the firm’s investment modus operandi and the firm’s pros and cons from both a qualitative and quantitative perspective, thereby painting an initial picture of the lucrativeness of the opportunity.

Forming an opinion of the GP using sell-side materials provided by the deal agent was the primary hurdle. These materials are created to market the firm and its funds in a positive light and try to hide the shortcomings and any red flags that the fund may have.

To overcome the hurdle, the TresVista Team conducted additional research and deep-dived into the numbers to help paint an accurate picture of the PE firm.

• Understanding how sell-side materials are used to perform buy-side analysis to evaluate how attractive prospective investments are and how they synergize with overall portfolio

• Learning how specific quantitative metrics are utilized and benchmarked against public indices to perform fund-level and portfolio company-level analysis

• Identifying sustainable competitive advantages of a firm’s investment strategy and presenting an opinion on the same through crisp commentary

The TresVista Team filtered out the deals that did not align with the key objectives and also provided a COVID-19 related analysis on the current and projected numbers to help demystify the uncertainty in the industry due to the pandemic.