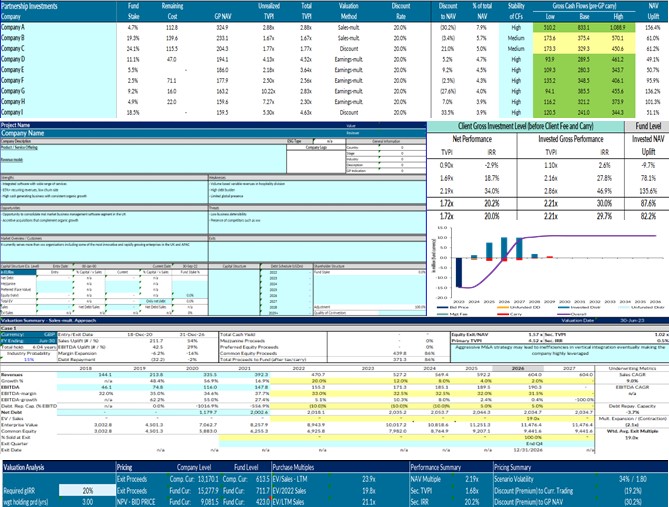

The client, a Private Equity firm, asked the TresVista team to build a fund model and sent relevant fund documents. They also provided specific guidelines regarding pricing cut-offs of 1.4x TVPI and 15% IRR. Since, the fund had large number of portfolio investments, the team was asked to model the top 15 investments by portfolio NAV as large investments wherein, the team had to model both qualitative and quantitative segments of the investments under three cases (Low, Base and High) and the remaining investments as small investments wherein, the team had to just model the quantitative segment of the investments. Further, the team was required to model the fund’s management fees, unfunded cash flows and post-record distributions.

To model a fund comprising of private and public portfolio companies for an LP-led secondaries transaction.

The TresVista Team followed the following process:

• Setting up the model: Used resources provided by the client (FS, Quarterly Report, and CAS) to set up the base through Input tab and Fund Summary tab of the model

• Qualitative Analysis: Analyzed individual portfolio companies based on qualitative aspects of the investments

• Quantitative Analysis: Modelled individual portfolio companies on each asset tab through discount/sales multiple /earnings approach

• Adjustment: Analyzed the forecasted net return on individual asset tabs based on their exit dates and multiples

The major hurdles faced by the TresVista team were:

• Desktop search for qualitative data on portfolio companies was difficult due to the scarcity of public information

• Complications arise when a fund has multiple sleeves. Here, the team was required to identify the sleeve and scale down the reported figures to accurately reflect the Seller’s Position

• Different GPs publish their GP reports differently; this often leads to challenges for the team in order to fill in the individual asset tabs

• Accounting for Post-Reference Date Distributions that occur between the reporting date and valuation date requires adjustments

The team overcame these hurdles by leveraging the company websites to gather qualitative information to understand the business and the revenue model. The newsroom of the company websites was useful to understand recent updates within the organization including any recent acquisition. To understand the sleeve, the team leveraged the partnership agreement to understand the sleeve it had to model, and scaled down the fund level information to the respective sleeve based on the sleeve percentage. The team contributed extra time to populate the asset level information from various sources due to the irregular reporting of information in the Quarterly Report. Further, the team modelled additional cash flows to account for the post-reference date distributions which further incorporates the proceeds in the pricing of the fund.

The TresVista team actively looked for anomalies and errors in the template while working on it and reported it to get it corrected. The team also reported any updates and developments to the investments in each fund that have not been captured in the latest GP Reports, which includes exits, M&A, and distributions, all of which affect the valuation of the particular investment.