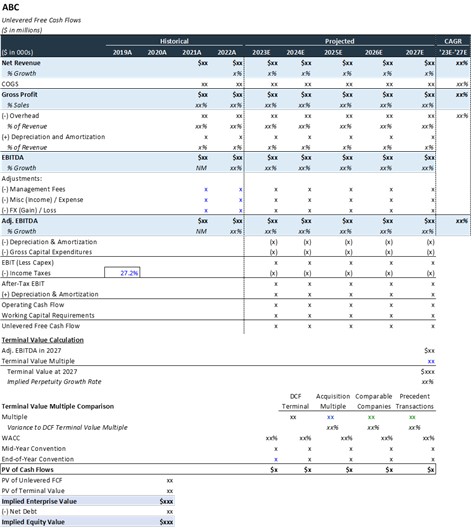

The client, a Private Equity firm, asked the TresVista team to change the method of valuing one of the client’s potfolio companies from post-money equity value to DCF, Trading, and Transaction analysis. The client wanted a calculator with three different methodologies. They wanted to change the valuation method since their investment in the company was already over a year old.

To change the method of Valuing one of the client’s holding companies from Post-money equity value to DCF, Trading, and Transaction analysis.

The TresVista Team followed the following process:

• Firstly, the team went through all the model format the client has shared in the past to get the reference

• Later the team started by creating the templates for all three methodologies with a tab summarizing the valuation from these methods

• Once the template was prepared, the team screened through the company financials and listed down all the necessary line items for the calculation of DCF valuation

• The team then conducted research to find comparable companies and deals to use in valuation analysis

The major hurdles faced by the TresVista team were:

• The major difficulty the team faced while calculating the FCF was due to the availability of limited data

• Forecasting future cash flows and considering assumptions is also one of the main tasks that the team has to deal with, since the DCF model is very sensitive to the data and the assumptions used

• Another challenge was finding relevant deals as the personal products industry spans many different segments

• As the personal product industry has various segments, this made finding a true public comparable difficult to find

The team overcame these hurdles by doing in-depth research regarding the personal product industry and got to know the specifics of the portfolio company. For trading comps, the team had considered taking companies which were in the required specific category. The team also considered a few of the companies which were into products that were competitors in the market. As for the limited data, the team took reference from the valuation methodologies followed for other portfolio companies prepared by TresVista.

The TresVista team apart from traditional DCF valuation method, also conducted a trading and transaction comps, and instead of just roll forwarding the previous valuation method the team built a whole deck for the client.