The client, a Secondaries Private Equity firm, asked the TresVista team to evaluate the existing LP’s stake across various PE funds. The client places bids on target funds after significant evaluation of the portfolio companies and the fund-level data. The end goal of the client was to evaluate the fund based on the outlook of its portfolio investments and place bids on the LP’s position based on its pricing cut-offs.

To prepare the fund model for each PE fund to evaluate the portfolio companies across the fund and understand the expected returns to the LP

The TresVista team followed the following process:

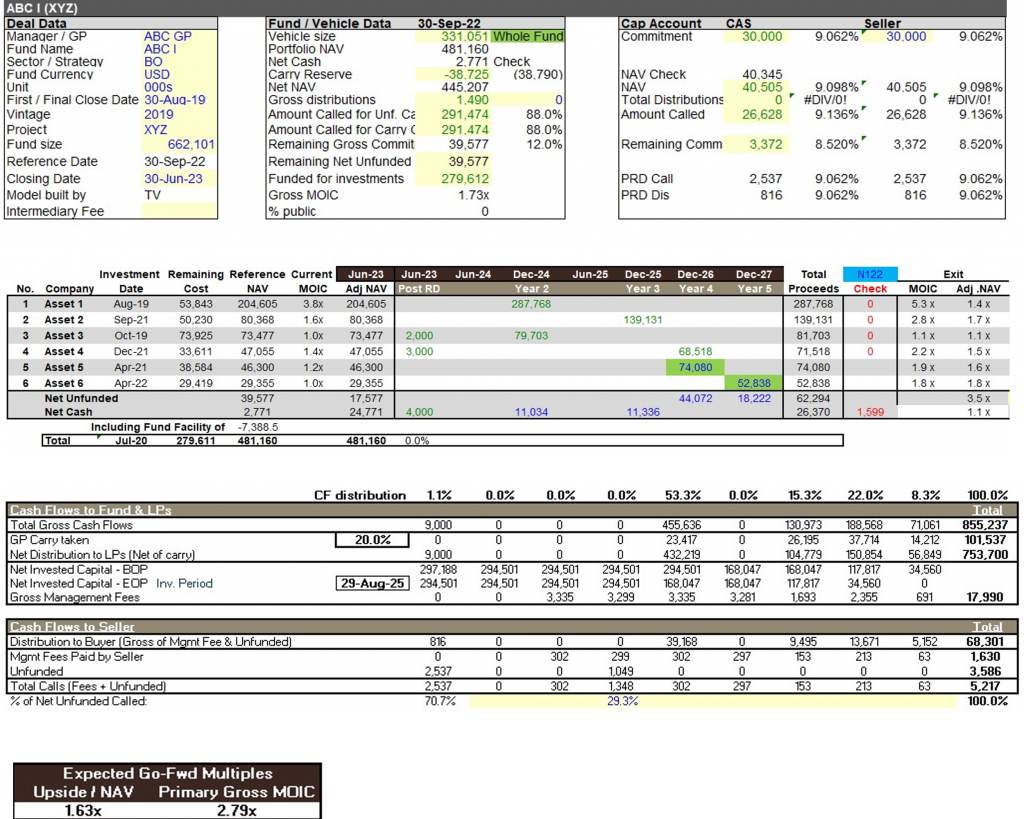

• Incorporated the fund level and asset level details from the GP reports in the Backup and Fund tabs

• Individual valuation of the assets in the portfolio were conducted after all the checks in the Fund tab were in place

• Ensured all the portfolio metrics and the implied price being calculated in the Model Dashboard section tie out and are consistent with the team’s expectations of the fund

• The final deliverable included the fund model, valuing all unrealized assets and a roll up tab determining the price at which the buyer should purchase the stake in the fund

The major hurdles faced by the TresVista team were:

• Paced deadline and quick turnaround for the deal flows: A secondary deal flow comes with a stringent timeline and quantum of work as the bids are to be placed at the earliest to increase the chances of winning

• Unavailability of required information: Quarterly Reports, shared with the LP, often did not contain the equity value and net debt data or historical performance records required for underwriting the asset

• Lack of public competitors for niche industries: There have been instances where the portfolio companies operate in a very niche market, hence pure-play listed competitor for these companies were not available

The team overcame these hurdles by making sure the resources were staffed in an effective manner to meet the timelines set by the client. Initial scoping of the files was conducted to find and tackle any complications that may arise later. Existing models prepared for the fund in past were leveraged to reduce the execution time. In instances where the data was limited the client was reached out to enquire about the existence of any additional files at their end. Additionally, publicly available data was also used to underwrite the asset. If no relevant data was discovered upon exhausting all the above-mentioned methods, relevant upside/downside in the cashflows were shown according to the company’s current performance. In cases where pure play public competitors operating in the same space were not available, the search was expanded to companies that have a segment that operates in a similar space to get a close proxy for multiples.

The TresVista team reported any updates and developments to the investments in each fund that had not been captured in the latest GP Reports – which includes Exits, M&A, and Distributions, all of which affect the valuation of the particular investment. The team also provided in depth company analysis for a few top companies to understand their business model by referring to broker reports and industry reports. Additionally, the team helped the client in tracking the quarter-on-quarter performance of the client’s existing investment.