The client, an Investment Bank, asked the TresVista team to prepare the Bid Book and monitor the bids tendered by the buyers who submit the bids on a pre-decided date after the execution of an NDA. The team was also asked to update the transfer output, based on the progress of the transfer process shaped by conversations and engagements between clients, GPs, and potential buyers. The team also had to monitor the portfolio summary and revise it to incorporate the latest cash flows, ensuring an up-to-date representation and audit of the comprehensive capital account. Post that the team had to prepare the Purchase and Sale Agreement (PSA).

To prepare the Bid Book and monitor the bids tendered by the buyers who submit the bids on a pre-decided date after the execution of an NDA.

The TresVista team followed the following process:

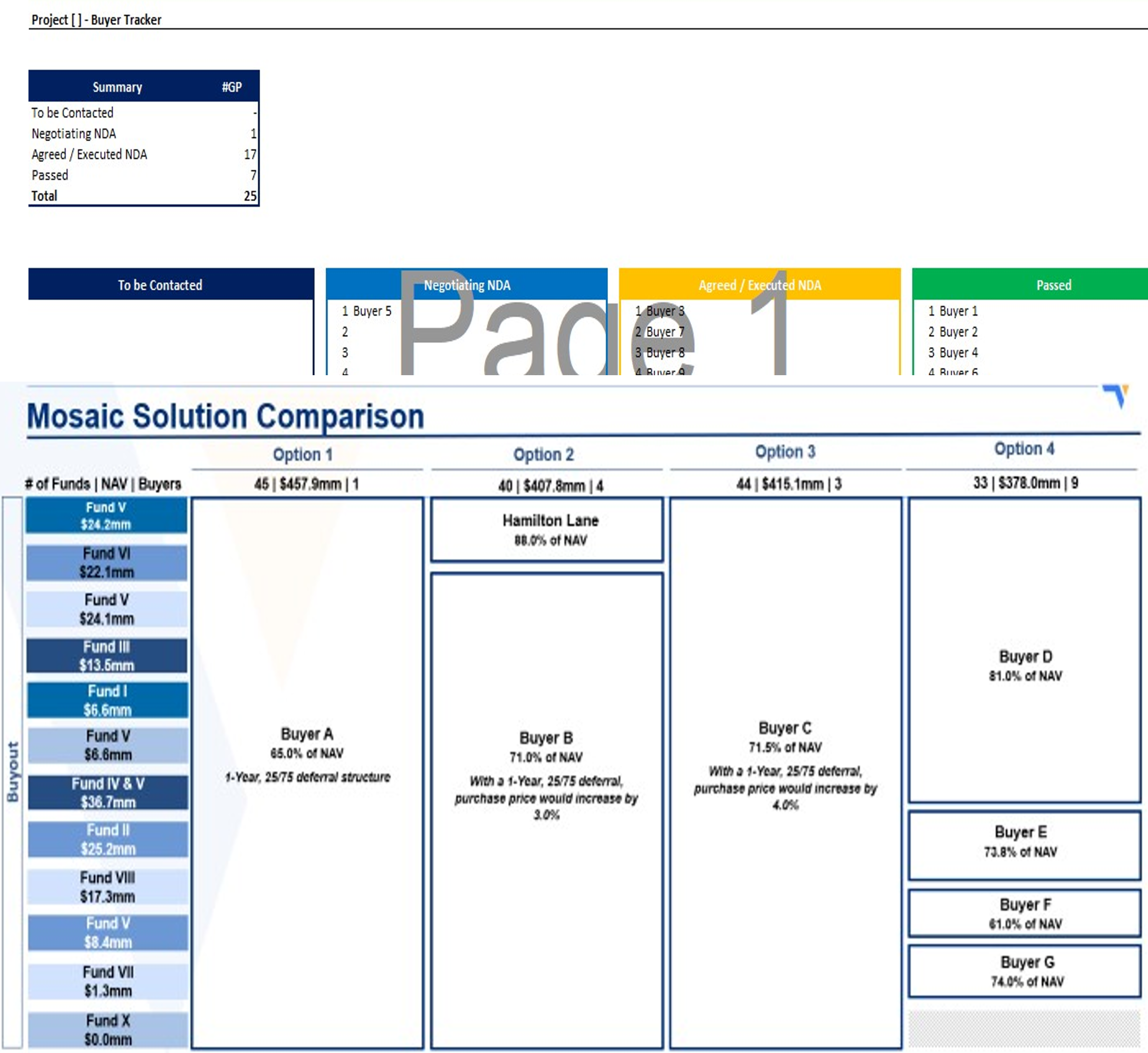

• Buyer Engagement: Evaluated the bid book after buyers submitted their bids

• Finalized Buyer: Conducted final negotiations with the competitive buyers

• GP Communication: Sought buyer approval from fund managers and collected the draft transfer documents

• Transfer Process: Coordinated negotiations of transfer documents between the buyers, sellers, and GP counsel

• Closing: Confirmed federal wire reference numbers, wire receipts, release of signature pages and closed the transaction

The major hurdles faced by the TresVista team were:

• Managing the PSA as there were multiple selling entities and buyers involved

• Tracking the conversation between multiple legal counsels involved in the transaction

• Chasing the Legal Counsels for timely responses

• Negotiations restrictions with few GPs led to delay in transfer

• Transfer complications faced with funds that have any ROFO, ROFR and PTP issues. These conditions could usually be waived off by GP, however, when this was not possible it led to delay in transfer

The team overcame these hurdles by discussing with the client the general geographic dynamic of the portfolio before beginning the tracking and decided the hours at which subsequently the client and the TresVista team would update the tracker. The checks and balances created to track the last contact with various buyers were used to increase transparency as the team followed up with client to get an update regarding the concerned GP/Buyer. The portfolio was closely monitored to see if the funds dropped off from the sale portfolio or late additions were made.

The TresVista team comprehended the secondary deal both from an LP and GP’s viewpoint to deliver on the expectations with the best possible outcome for the seller. The responsibility of communication between the GPs and the legal counsels was split between the TresVista team and the client which increased the efficiency. The team gained knowledge on various legal covenants like PTP, QMS, ROFO and ROFR that might have restricted a fund’s marketing and would have affected deal dynamics. The process was accelerated through effective distribution of work among the teams, leading to successful deal closure within a span of three months.