The client, a Financial Database firm, asked the TresVista team to prepare create historical financial models for public and private companies which includes spreading of 3 financial statements, EBITDA schedule, capital structure table with detailed debt break down along with company overview.

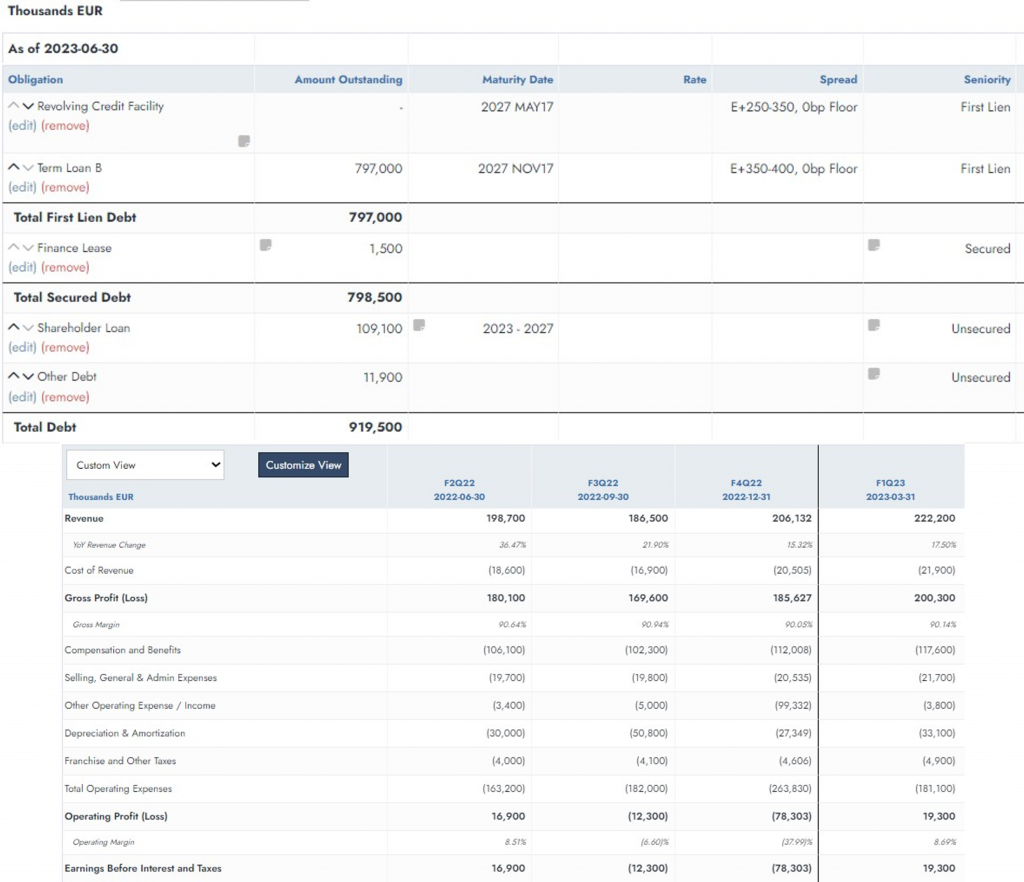

To create historical financial models for public and private companies which include spreading of financial statements, EBITDA schedule, capital structure table along with company overview.

The TresVista team followed the following process:

• Sourcing Documents: The documents were sourced from public sources such as SEC and company websites and private sources such as internal document repository

• Financial Statements Spreading: Spreading the data included extracting income statement, balance sheet, cashflow statement and EBITDA schedule and tagging the particulars as per the client’s taxonomy

• Creating detailed debt structure: Comprehending each type of debt and capturing principal amount and other details

• Equity value: Equity value was considered as per market capitalization for public companies and as per deal-based transaction multiple for private companies

• Making Model Consistent: Ensuring consistency in tagging financial line items and data uniformity among the 3 statements

The major hurdles faced by the TresVista team were:

• Inconsistent financial reporting & limited disclosures in private company’s reports

• Absence of generalized EBITDA schedule

• Tagging of financial line items in the client database as per the pre-defined taxonomy and making the line items consistent across periods

• Collating Debt information from company reports and credit agreements

• Complex terminology and legal terms associated with debt

The team overcame these hurdles by using their experience of working for multiple companies to improve familiarity with private companies’ irregular reporting and to standardize their format. The team also created a checklist to ensure that no crucial point was missed, ensuring accuracy. Client’s feedback was incorporated to identify the most important parameters to avoid omitting them. The team created shortcuts to quickly search for key debt-related terms and information in lengthy legal documents, which saved time and improved accuracy.

The TresVista team provided regular feedbacks based on their experience of spreading the financials of multiple companies to improve the taxonomy ; created debt amortization and reconciliation tables for companies which had multiple debt and amendments to those debts; explored alternate websites which feeds the alerts for subscribed companies to the analyst’s mailbox and thereby eliminating the risk of missing any important update.