The client, a Private Equity firm, asked the TresVista team to create a shortlist of LPs who plans to get exposure in PE/Credit firms, earmark new PE/Credit firms, or have shown interest/invested in the client’s competitor. The client provided a list of conference attendees comprised of single, multi-family offices, and RIAs and another list of competitors for both PE and Credit.

To create a list of potential LPs who might be interested in taking meetings at an upcoming conference as a part of the fundraising efforts for their upcoming fund.

The TresVista team followed the following process:

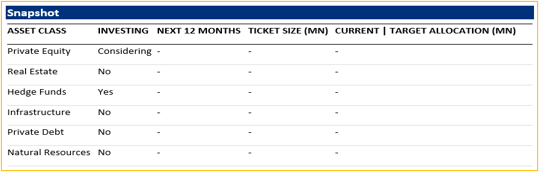

• The team received a list of potential attendees of a conference the client planned to attend for finding LPs for their upcoming fund

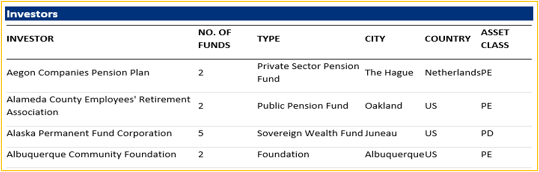

• The team then identified all the LPs and further categorized them based on the type

• As part of the preliminary criteria defined by the client, the team created a focused list of single and multi-family offices and RIAs

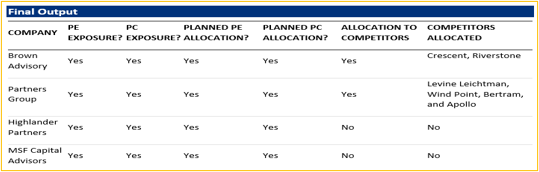

• The team further shortlisted prospective LPs based on their existing and potential allocation to the client’s competing private equity and private credit funds

• The team used Preqin, company websites, and news articles to conduct the research

The major hurdles faced by the TresVista team were:

• Identifying all the LPs and their current portfolios, particularly Family offices

• Not able to find appropriate information using Google searches such as company websites and web articles

• The client was not explicit enough about the end product format and therefore the team had to brainstorm a little on that

The team overcame these hurdles by deciding to use Preqin as a preferred source to apprehend the requisite information, which helped the team to identify the exact LP. As per the investment criteria and fund investment approaches, the team tried finding more relevant information about the LPs containing PE/Credit Exposure, Planned PE/Credit Allocation, Allocation to competitors, and Competitors exposed to (any given LP from the list).

The TresVista team helped the client to cross-reference LP allocations against GP’s investor base to provide deeper diligence which included LP allocation and GP investor base along with LP fund type and GP investment criteria.