The client, an asset manager, was concerned about a global pharmaceutical company’s board composition and cases of investor activism against corporate governance practices and wanted to conduct research on certain aspects of the company’s business lines and competitive landscape.

The TresVista Team was asked to provide deeper insights to understand the company’s business segments, product pipeline, and future prospects, which will help the client take a call on his/her stock position.

To conduct research on the corporate governance practices, business segments, product pipeline, competitive landscape, etc. of a pharmaceutical company. The TresVista Team was also required to project the company financials and prepare a DCF-based valuation model.

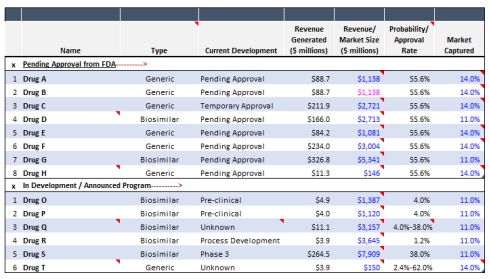

The TresVista Team started off by conducting research on a list of questions/research points outlined by the client. A word and excel document was shared with the client which summarized the research findings related to the pharmaceutical industry, past corporate governance issues, company’s drug pipeline, and probability-weighted revenue generation capacity.

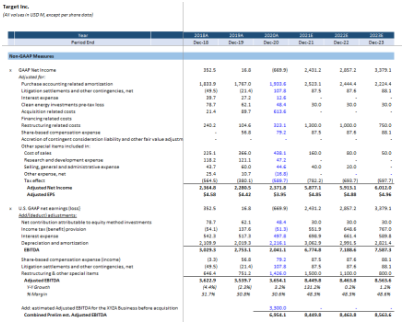

After sharing the research findings, the TresVista Team started spreading the historical financials of the company and prepared a DCF-based valuation model with the help of the company’s filings, transcripts, and sell-side reports. The project request was broken down into smaller tasks to maintain efficiency at each step.

The major hurdle faced by the TresVista Team was to get familiarized with the pharmaceutical industry dynamics, value chain, types of products, and the company’s diverse portfolio, along with the lack of clarity in the prospects of the biosimilars industry in the U.S.

• How the lack of corporate governance affects the stock price and investors’ sentiments

• Identified bottlenecks and reasons for the slow uptake of biosimilars in the U.S. compared to the E.U.

• The study of future trends concluded that there are growth opportunities, however, a lot depends upon the acceptance of biosimilars

The TresVista Team conducted an exercise covering probability-weighted revenue generation capacity of the company’s drug pipeline. The research and analysis helped the client better understand the industry dynamics and take a call on his/her stock position.