The client, an Alternative Asset Management firm wanted the TresVista team to substantiate and clean up balances in the management fee receivable accounts at the fund and entity level to bring them in line with the client’s fund accounting team reports by writing off the excess receivable booked. The client wanted the team to conduct monthly reconciliations to match the balance sheet position in the accounting ledger against the closing unpaid balances with the fund accounting team reports. The client also wanted to add further controls and checks to streamline the process of booking management fee receivables and income.

To Investigate the root cause of variances across different asset classes and propose solutions to clear historical balances.

The TresVista team followed the following process:

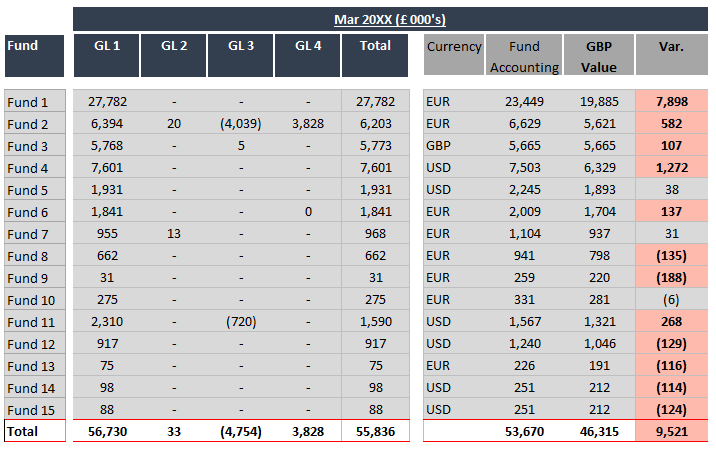

Pulling Inception to Date Balances: Cleaned the historical balances, started with pulling the data from the accounting software and linking the management fee model with the client’s fund accounting balances which were the two sets of numbers to be reconciled

Checking for Inconsistencies: Investigated at fund and entity level to identify the reasons and incorrect postings causing the variances

Posting Write-off Entries: Prepared write-off journals to clear the excess accruals and streamlined the process to avoid future variances by making a monthly process of control checks for the fee income recognized

The major hurdles faced by the TresVista team were inconsistency in the approach followed by fund accounting in preparing reports leading to incorrect balances and false variances, reclassing invoices and balances to appropriate fund codes and account codes, understanding various sets of book entries posted to depict fund flow between General Partner entity and the Alternative Investment Fund Manager and substantiating the entries posted by the employees who were no longer a part of the firm.

The TresVista team overcame these hurdles by communicating with the client’s fund accounting team for a better understanding of the model and for confirming the fee income figures and closing balance. The team investigated the wrong postings by drilling down all transactions and posting the reclassification entry.

The TresVista team investigated and cleared historical balances at the group level to match the balances in the client’s books with the fund accounting figures. The team ensured any PL impact posted at General Partner level was passed on to the Alternative Investment Fund Manager and verified there were no intercompany breaks in the process. The team assisted in implementing a centralized invoicing sales ledger to raise management fee invoices across fund ranges and built automated control checks to ensure accruals across fund ranges were posted in the correct Entities in line with fund accounting figures.