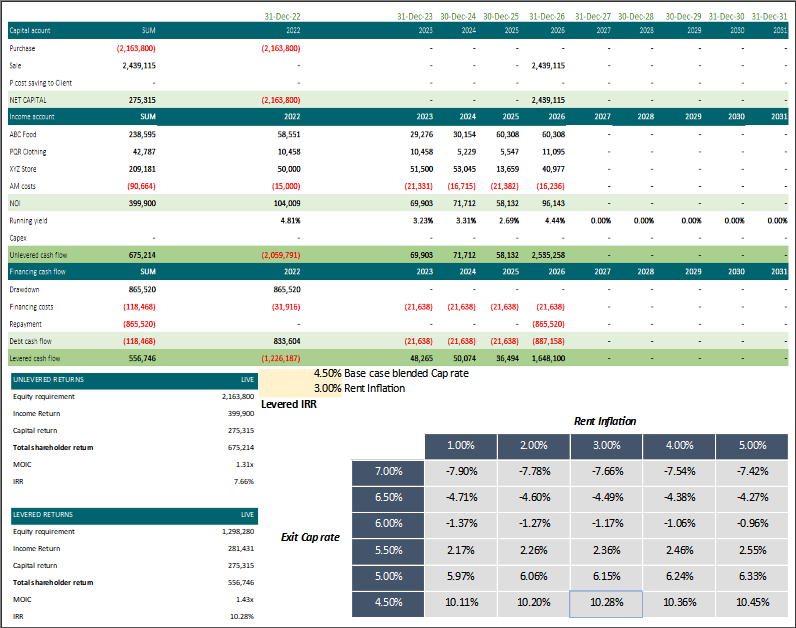

The client, a UK-based REIT that focuses on purchasing Retail Park properties and leasing them back to supermarkets or non-food retail stores, wanted the TresVista team to review and fix the broken ‘Buyout Model’ used to evaluate Retail Park properties.

To fix and review the broken ‘Buyout Model’ to evaluate commercial real estate properties.

To make the model error-free, the TresVista team dug deep into the model to understand the flow and technical concepts on which the model was functioning. A clear understanding of the real estate industry’s concepts and technical aspects helped the team review and fix the broken ‘Buyout Model.’

The major hurdle faced by the TresVista team was the complex methodology, associated with the extensive model and the jargon for the real estate industry, combined with the working of the model.

The TresVista team overcame these hurdles by working diligently on the model by understanding its flows, technical aspects, and industry trends wherever required.

The TresVista team improved the model’s layout to accommodate multiple commercial properties for evaluation which required adding multiple rows across the different tabs of the model. The team also added functionality (switch) to evaluate only selected tenants in commercial property (food vs. non-food).