The client, a Private Equity firm, asked the TresVista team to assist on all fund admin-related requests starting from the fund setup on QuickBooks to the preparation of financial statements, preparation of individual partner’s capital accounts and statement of positions and resolving audit queries. For this, the client provided the supporting documents and a template which were required for preparing the tax workbooks and financials in an orderly way.

To timely file tax returns by preparing the financial statements for different fund families and assist the client in end-to-end admin support against multiple requests

The TresVista team followed the following process:

The major hurdle faced by the team was the issue of discrepancies in the values of investors’ management fees and carried interest rates. While preparing the WB for tax returns, the team observed that carried interest and management fees were not correctly reflected. No amends to the terms of the contract for LPs (Limited Partner) were updated on the website, leading to incorrect reports being exported. These reports were taken as a base for the accounting WB, hence causing hindrances in the process.

Additionally, the template that the client provided was a little complex and unable to pull the accurate values for change in contributed capital, and distributions, and was not suitable for funds with a period of more than 3-year figures.

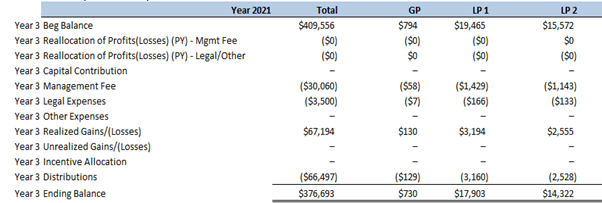

The team overcame these hurdles by deeply analyzing the whole situation, handling the inaccuracy, and giving back-end support to the client’s portal. For this, the team gathered individual investors’ Tax IDs, made sure the amounts for contributed capital and the committed capital were correct, searched side letters, and scrolled through the operating agreement to pull out all the discrepancies. The team prepared allocation tables to reflect the accurate expense allocations and LP ending balances.

The team prepared the primary financial statements that the client needed for filing tax returns across multiple funds within the stated timelines and navigated through operating agreements and side letters to identify different fee rates against investors. Additionally, the team learned about the whole life cycle of the fund from its inception on online platforms till its liquidation in the accounts. Further, to manage the multiple requests from different requestors, the team streamlined the whole process into smaller and simpler tasks by working alongside the FPS team and completed the project effectively and efficiently.