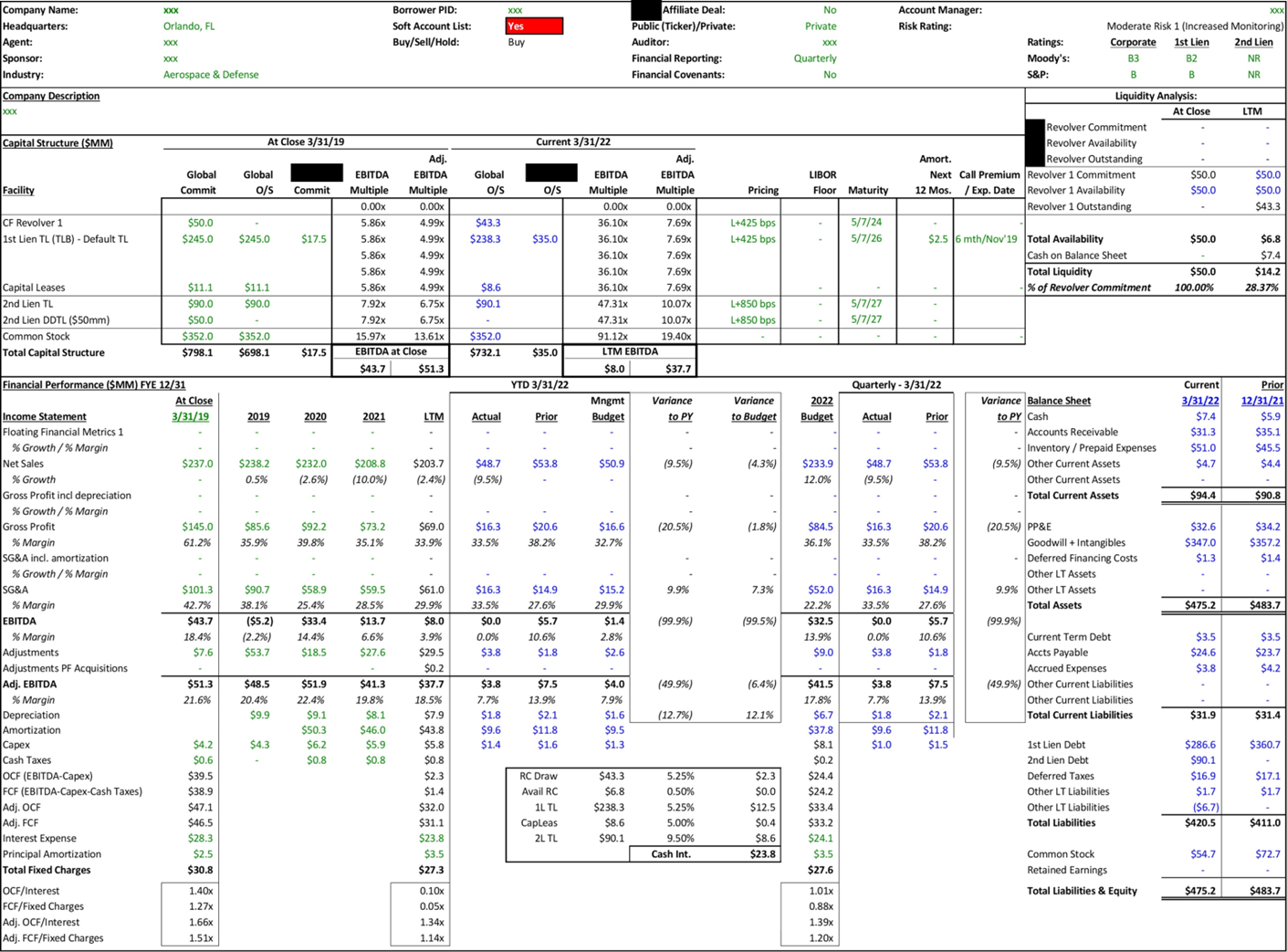

The client, a Private Debt firm wanted the TresVista team to track and monitor the financial performance and perform debt coverage analysis for every portfolio company. The client also requested to upload the PMR on its internal server from where it can monitor the health of portfolio companies and keep a track of the terms of the deal. The client received various quarterly/monthly performance reports from the borrower, which were uploaded to its database or shared with us.

To track and monitor the health of each of its portfolio companies.

The TresVista team followed the following process:

• The team updated the financials and all required metrics in the PMR template regularly (quarterly/monthly based on the Credit Agreement) and uploaded it on the client’s server. The team processed ~100+ PMRs per reporting period

• The updates were made using various reports/documents as provided/available. The team went through the Compliance Certificates, Lender Updates, GAAP financials, Credit Agreement, etc. to source and updated the required metrics

• After making the updates in the PMR, the team also prepared an audit backup providing sources for all the key metrics mentioned in the PMR

The major hurdle faced by the TresVista team was that a significant portion of the template had to be revamped for all ~350+ portfolio companies to reflect those metrics to ensure uniform reporting of all portfolio companies.

The TresVista team overcame this hurdle by deciding to track/monitor a few additional metrics and incorporate the same as part of its PMR template.

The TresVista team established a link between different reporting documents, as PMR updates required the team to go through different quarterly/monthly reports. The team also understood if there were any changes/updates to the existing capital structure (addition of a new tranche, incremental debt on an existing tranche, change in the interest/amortization rate, etc.), the team had therefore developed a good understanding on various terms and trends prevalent in the industry. This also helped the team to form an understanding of how portfolio companies are evaluated from a financial lens, and which metrics are frequently used to track the borrower’s performance.