The client, a Secondaries Private Equity division of a global alternative asset management firm, requested the TresVista Team to prepare ~24 fund models. The client was evaluating a deal, wherein they were looking to purchase Limited Partner (LP) stake in ~100 funds and place a competitive bid after evaluating all the funds and examining their underlying assets.

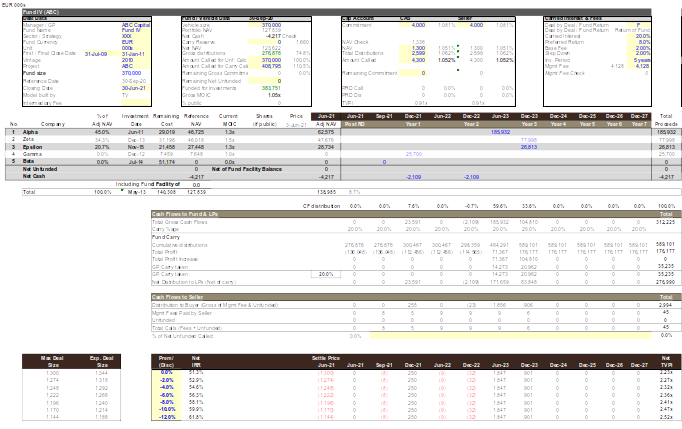

To prepare a fund model with the help of the documents provided by the General Partners (GPs) and evaluate returns and fund performance. Also, prepare a comps analysis for the underlying assets in the fund using CapIQ.

Following were the steps taken by The TresVista Team to prepare the model:

The challenges faced by the TresVista Team were:

• Lack of Availability of Information: Every fund manager uniquely presents their reports and statements, which leads to a different quantum of information available across funds

• Niche Companies: Assets operating in niche industries led to market information/outlook scarcity on the internet

For the details/information which were not directly available from the reports, the TresVista Team looked for related proxies and made assumptions regarding the same. For companies that were operating in niche segments, the TresVista Team tried to understand their sector through various secondary research reports, guidance from the GP, and databases. Projections were then made based on the industry outlook and performance of the company

The TresVista Team provided comments for each fund in the model and key takeaways in their email. This gave the client a rough idea about the fund and helped save time by reducing the need to go through the entire report to understand the strategy/track record of the fund.