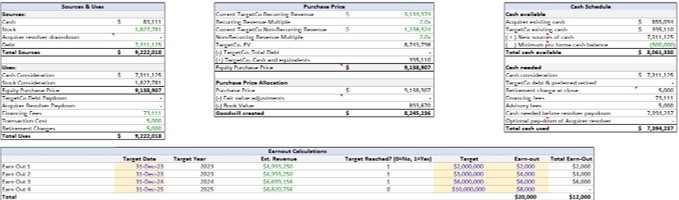

The client, a Private Equity firm, wanted the TresVista team to build a custom acquisition model with accretion/dilution and sensitivities analysis on top of the acquirer’s projection model where the client could easily modify the assumptions and deal structure. The broader task was to account for three acquisitions over the next year and create a model with proforma calculations, including seller paper and earn-out calculations.

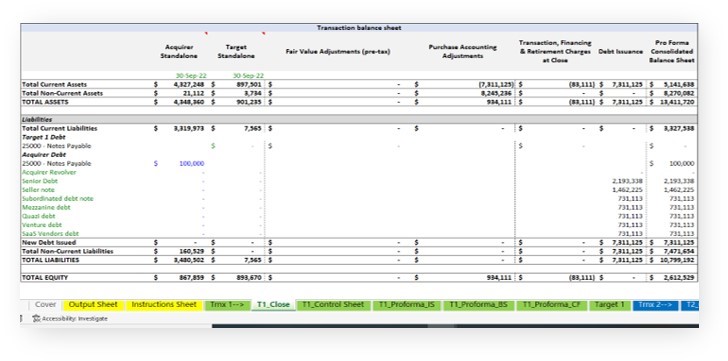

To build an efficient and memory-light model where future transactions can be easily added by duplicating the latest target and proforma tabs, making it accessible for the client to utilize as a base model.

The TresVista team followed the following process:

The team constructed a multi-layered format such that the post-acquisition pro-forma statements were a combination of the previous consolidated company and the new target. Every time a new target was acquired, the pro-forma financials of the previous transaction became the base for the new one. The team created on-off switches for the optional pay-down of the acquirer revolver, Section 336(e) election, earnout calculations, and a kill switch for the transactions.