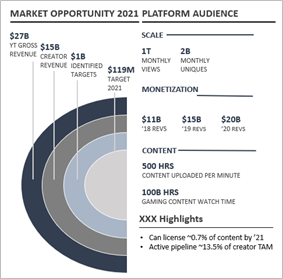

The client, a US-based Private Equity firm that invests in consumer, sports, and media, wanted TresVista Team to research recent trends in the digital media sector and digital advertising ecosystem. The client also wanted the team to rebuild the operating model with two revenue streams and create and update valuation materials and Investment Committee (IC) memos.

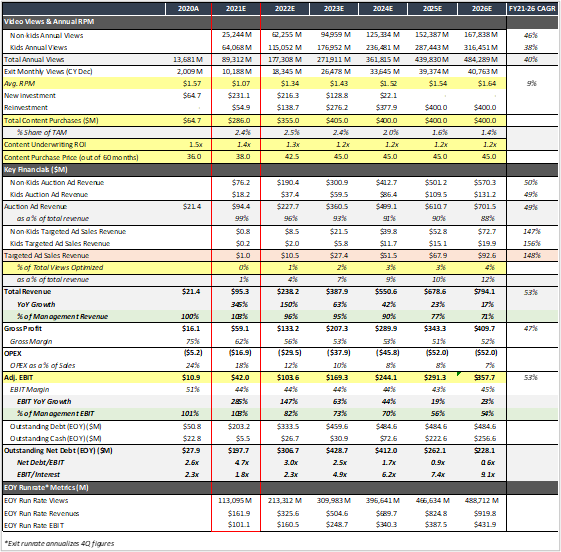

To rebuild an operating model and creation of valuation materials through different stages of the deal lifecycle.

The TresVista Team followed the following process:

The major hurdles faced by the TresVista Team were:

The team overcame the hurdles by deep diving into the economics of YouTube creators. The team also had calls with the client to understand the business model.

The TresVista Team built a run-off model where the company ceases all operations, stops all new content purchases, fails to build ad optimization, and runs the business for cash with ~10% of expected opex. The team also made an IPO exit model where the client will sell down in three equal-sized 6-month blocks starting 6 months after listing.