The client, a Family Office investing in the Healthcare space in the United States, keeps a close track on recent developments and upcoming trends to analyze new opportunities and their impact on the portfolio.

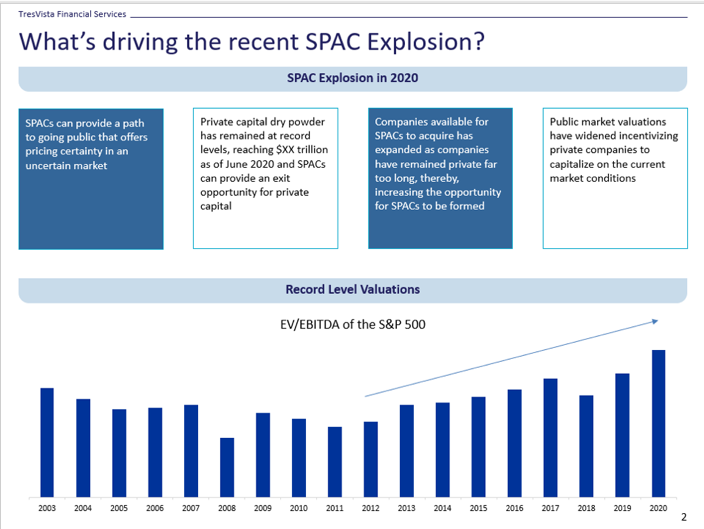

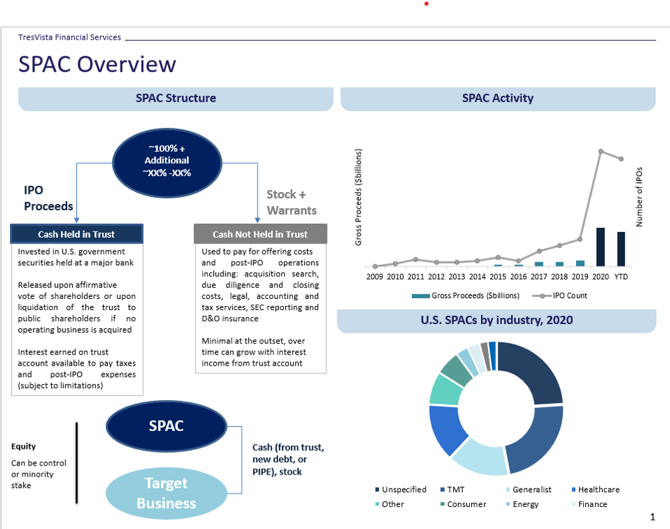

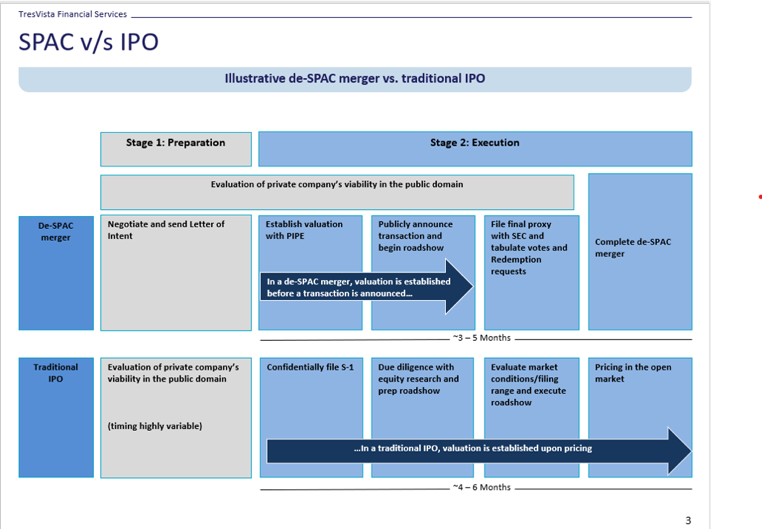

The task at hand was to get an overview of the SPAC landscape and analyze de-SPAC transactions in the Healthcare sector over the past three years. The client asked for a detailed summary of SPAC transactions in Healthcare sector including transaction details, target company description, management details of the SPAC and target company, and an analysis of the prospectus.

To prepare a research report on SPACs and showcase its current landscape and future trends. Other guidelines given were:

The TresVista Team spent time understanding how SPACs work and then gathered public information through a combination of desktop research and third-party databases. Additionally, relevant pieces of information were captured from press releases, articles, and reports published by research agencies and opinion columns. After verifying the relevance of the data, the TresVista Team compiled industry metrics highlighted by the client and presented SPAC transactions in the Healthcare sector in a format that was concise and orderly. The TresVista Team was subsequently engaged to periodically update the transaction details and other statistics.

The large volume of unverified data gathered through public sources made it challenging to utilize into the broader process.

The TresVista Team tackled these hurdles by carefully understanding the inner-workings of a SPAC by combing through articles, posts, blogs, and videos and then verified each industry metric with multiple sources.