The client, an Investment Banking firm, asked the TresVista team to develop a solution for a diversified portfolio sale in a private secondary transaction to maximize the sale proceeds and the sale portfolio size. The main objectives of the seller included – repositioning portfolio to enhance go-forward returns, maximizing the sale portfolio size without sacrificing price, closing majority of the sale by the year end, and considering deferred payment structure to improve pricing.

To maximize the sale proceeds and the portfolio size in a private secondary transaction.

The TresVista team followed the following process:

• The team received the bid data from the client and analyzed it for the best opportunity

• The team suggested a single buyer solution to the client but some portions of the fund were unallocated, so the client wanted to go for a second round of bid

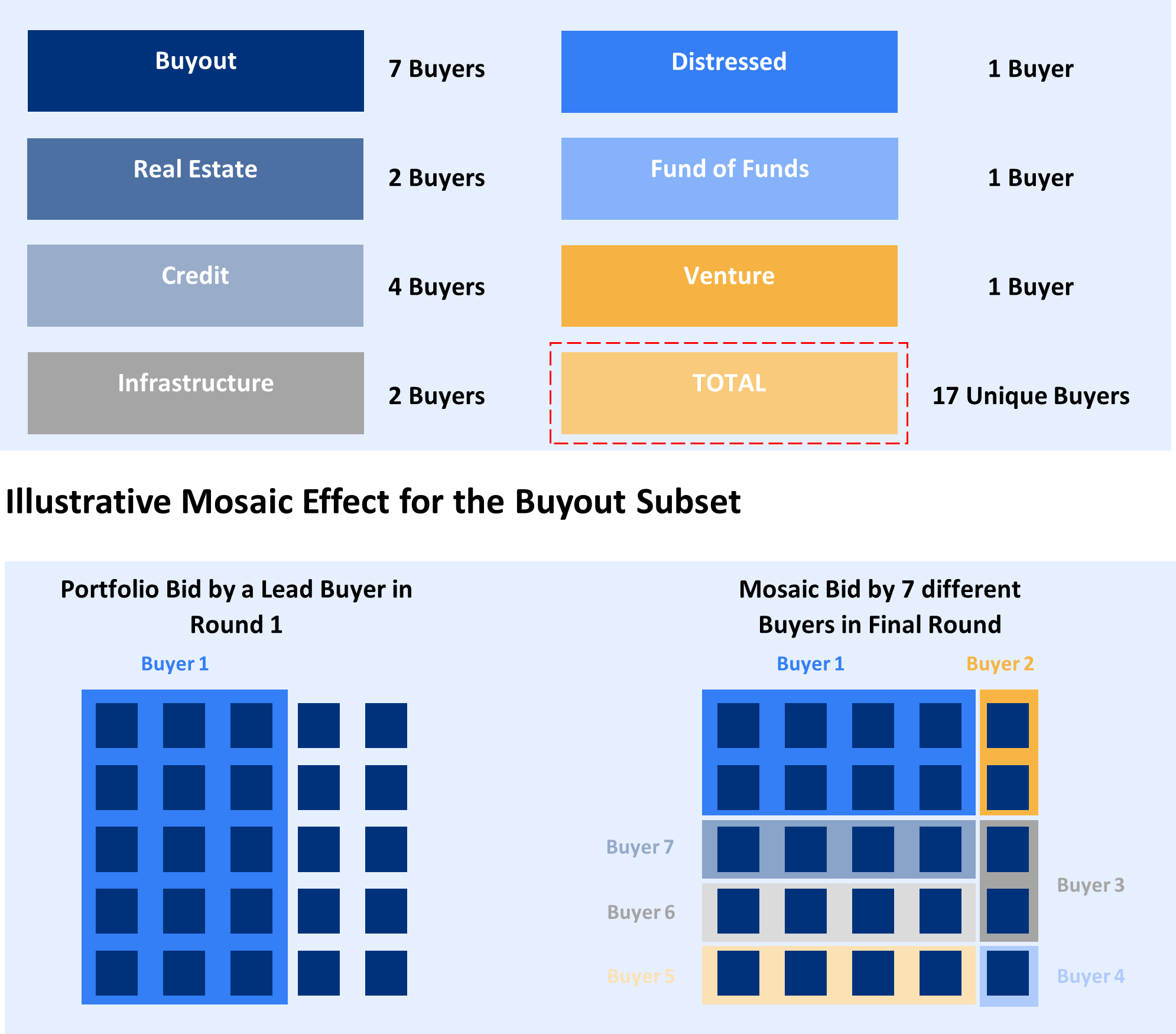

• In the second round, the team followed a multiple buyer approach through MOSAIC analysis which increased the allocation by few basis points

The major hurdles faced by the TresVista team were:

• The addition of more buyers in a mosaic solution led to an increase in communication between all parties involved

• Ensuring that everyone’s interests aligned was an enormous undertaking

• AML and KYC issues led to the delay of 6.4% of the proceeds

• Tight timeframe to successfully drive the execution of 37 PSAs and 111 transfer agreements in order to meet the goal of closing the transaction in Q4

The team overcame these hurdles by sending daily transfer status update emails to keep all the concerned parties on the same page, given the vast number of entities involved. The team also spent extra time and effort on creating complex PSAs for a few buyers with multiple buying entities.

The TresVista team assisted the client in increasing the portfolio pricing which helped them to increase their earnings through advisory fees and close the transaction successfully.