The client, a Private Equity firm wanted the TresVista team to understand market cycles and evaluate PE & VC investing decisions during recessions, to analyze if 2022 is any different compared to previous recessions and if it is a good time to invest, and why. The team was expected to suggest strategies that could be adopted and sectors that are worth investing in the near term.

To suggest strategies that could be adopted for investing in the near term during the recession.

The TresVista team followed the following process:

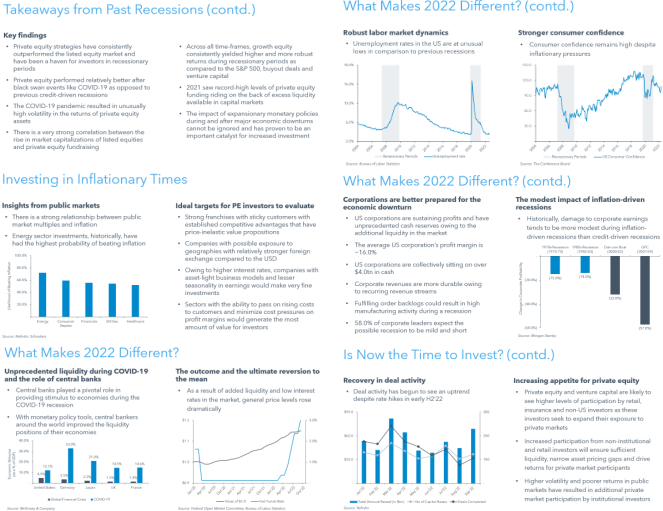

• Analyzing Past Recessions: Gathered risk and return data across PE asset classes and S&P 500 for the last 3 recessions

• What Makes 2022 Different: Sourced data points indicating how 2022 is different from previous recessions

• Is Now the Time to Invest: Derived insights from macro-economic, business, and deals data

• Strategies to Consider: Identified strategies PE & VC firms should use to add value to investee companies and investors

• Lucrative Sectors: Identified the latest trends in sectors with a high probability of generating returns

The major hurdles faced by the TresVista team were the limited availability of data, as this made it difficult to study the impact of past recessions on the PE & VC landscape and the constantly evolving nature of the PE industry made it challenging to compare past strategies and assess their suitability for the current environment.

The TresVista team provided a comparative account of performance across PE asset classes during the last 3 recessions, recommended strategic courses of action for PE firms to enhance value creation, and gave insights into investor behaviour and their interest in PE & VC.